Arbitrage

and Rational Decisions by Robert Nau, Fuqua

School of Business, Duke University

Published by Chapman

and Hall, 2025

Abstract:

“This unique book offers a unified

approach to the modeling of rational decision-making under conditions of

uncertainty and strategic and competitive interactions among agents. Its most

elementary axiom of rationality is the principle of no-arbitrage, namely that

neither an individual decision maker nor a small group of strategic competitors

nor a large group of market participants should behave in such a way as to

provide a riskless profit opportunity to an outside observer.

Both those who work in the finance

area and those who work in decision theory more broadly will be interested to

find that basic tools from finance (arbitrage pricing and risk-neutral

probabilities) have broader applications, including the modeling of uncertainty

aversion, inseparable beliefs and tastes, nonexpected utility, ambiguity, and

noncooperative games.

The book emphasizes the use of

money (rather than varieties of utility) in the quantification of rational

economic thought. It provides not only a medium of exchange and an objective to

maximize but also a language for cognition, interpersonal expression of

preferences, aggregation of beliefs, and construction of common knowledge in

terms of precise numbers. At the same time it provides an obvious standard of

economic rationality that applies equally to individuals and groups: don’t

throw it away or allow your pocket to be picked. The modeling issues that arise

here provide some perspective on issues that arise in quantitative modeling of

decisions in which objects of choice are less concrete or higher-dimensional or

more personal in nature.

One of the book’s key

contributions is to show how noncooperative game theory can be directly unified

with Bayesian decision theory and financial market theory without introducing

separate assumptions about strategic rationality. The no-arbitrage standard of

rationality leads straight to the conclusion that correlated equilibrium rather

than Nash equilibrium is the fundamental solution concept, and risk-neutral

probabilities come into play when agents are uncertainty-averse.

The book also provides some

history of developments in the field over the last century, emphasizing

universal themes as well as controversies and paradigm shifts. It is written to

be accessible to advanced undergraduates, graduate students, researchers in the

field, and professionals.”

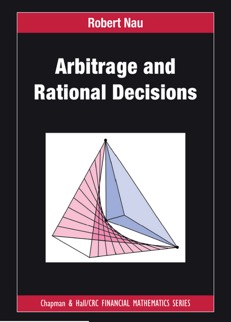

What does the figure on the cover represent?

If you

guessed "battle of the sexes," you are correct. The figure

illustrates a theorem concerning the geometry of the set of solutions of a

noncooperative game, as it applies to the 2x2 game known as

battle-of-the-sexes. (He prefers the boxing match, she prefers the ballet, but

they would like to go somewhere together rather than separately. What should

they do?) The red saddle is the set of independently randomized strategies. The

blue hexahedron is the set of correlated equilibria. Their three points of

intersection (black dots) are Nash equilibria. The obvious fair solution

(flipping a coin) is the midpoint of the long edge, which is not a Nash

equilibrium. This picture is generic in the sense that Nash equilibria always

lie on supporting hyperplanes of the set of correlated equilibria and as such

they cannot exist in its interior when it has full dimension as it does here. See section 8.4 of the book for details.