Notes on linear

regression analysis (pdf file)

Introduction

to linear regression analysis

Mathematics

of simple regression

Regression examples

·

Beer sales vs. price, part 1: descriptive

analysis

·

Beer sales vs. price, part 2: fitting a simple

model

·

Beer sales vs. price, part 3: transformations

of variables

·

Beer sales vs.

price, part 4: additional predictors

·

NC natural gas

consumption vs. temperature

·

More regression datasets

at regressit.com

What to look for in

regression output

What’s a good

value for R-squared?

What's the bottom line? How to compare models

Testing the assumptions of

linear regression

Additional notes on regression analysis

Stepwise and all-possible-regressions

Excel file with

simple regression formulas

Excel file with regression

formulas in matrix form

Notes on logistic regression (new!)

If you use

Excel in your work or in your teaching to any extent, you should check out the

latest release of RegressIt, a free Excel add-in for linear and logistic

regression. See it at regressit.com. The linear regression version runs on both PC's and Macs and

has a richer and easier-to-use interface and much better designed output than

other add-ins for statistical analysis. It may make a good complement if not a

substitute for whatever regression software you are currently using,

Excel-based or otherwise. RegressIt is an excellent tool for

interactive presentations, online teaching of regression, and development of

videos of examples of regression modeling. It includes extensive built-in

documentation and pop-up teaching notes as well as some novel features to

support systematic grading and auditing of student work on a large scale. There

is a separate logistic

regression version with

highly interactive tables and charts that runs on PC's. RegressIt also now

includes a two-way

interface with R that allows

you to run linear and logistic regression models in R without writing any code

whatsoever.

If you have

been using Excel's own Data Analysis add-in for regression (Analysis Toolpak),

this is the time to stop. It has not

changed since it was first introduced in 1993, and it was a poor design even

then. It's a toy (a clumsy one at that), not a tool for serious work. Visit

this page for a discussion: What's wrong with Excel's Analysis Toolpak for regression

Regression

example, part 4: additional

predictors

The log-log regression

model for predicting sales of 18-packs from price of 18-packs gave much better

results than the original model fitted to the unlogged variables, and it

yielded an estimated of the elasticity of demand for 18-packs with respect to

their own price. Specifically, the

slope coefficient of 6.705 in that model implied that, on the margin, a 1

percent change in price should be predicted to yield a 6.7% change in demand in

the other direction. But what about

prices of the other carton sizes?

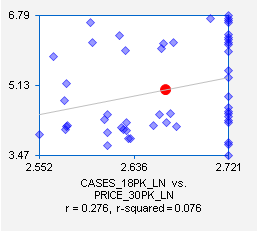

It is reasonable to expect that there will also be substitution effects,

i.e. “cross-price elasticities.” Consumers ought to buy relatively more

[fewer] 18-packs when the price of another carton size is raised [lowered]. Indeed, the correlations and

scatterplots for sales of 18-packs vs. prices of 12-packs and 30-packs (taken

from the original scatterplot matrix) suggest that there are such effects:

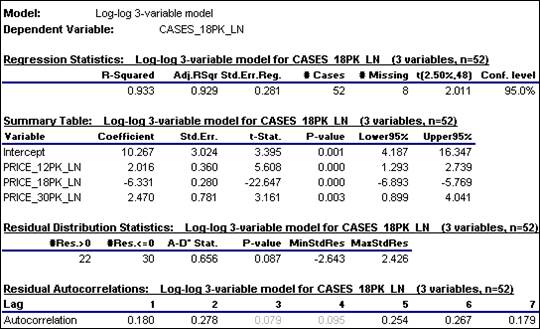

To test this hypothesis, let’s add these two variables to the

previous model. Here is the model

summary report produced by RegressIt:

The

coefficients of the two additional variables are significantly different from

zero, and most importantly there has been a significant reduction in the

standard error of the regression, from 0.356 to 0.281. Recall that errors measured in log units

can be roughly interpreted as

percentages, if they are on the order of 0.2 or less. These numbers are a bit too large for

that approximation to fit very well, but still, very roughly speaking, the standard deviation of the errors in

percentage terms has been reduced from around 36% to around 28%, which is a

meaningful improvement. (Return to top of page.)

The

estimated coefficient of PRICE_18PK_PN (-6.331) is very close to its value in

the previous model, which is good:

it means the own-price effect is fairly robust to the manipulation of

the other prices. The estimated

coefficient of 0.2016 for PRICE_12PK_LN (its cross-price elasticity with

respect to sales of 18-packs) means roughly that a 1% increase [decrease] in

the price of 12-packs should be predicted to yield a 2% increase [decrease] in

sales of 18-packs, other things being equal. For 30-packs, whose coefficient is 2.47,

the effect is a little stronger.

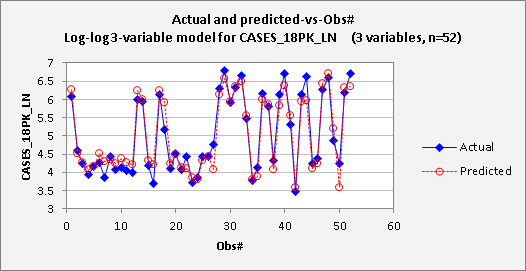

Now

for the plots. The

actual-and-predicted-vs-obs# plots appears to show a very nice fit:

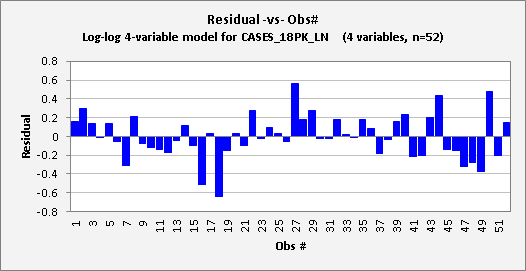

However,

the residual-vs-obs# plot indicates a bit of a problem: there

is a noticeable time pattern in the errors, namely an upward trend. (Errors in the first half of the year are

nearly all negative, while those in the second half are mostly positive.) This pattern is also reflected in the

residual autocorrelations, which are positive at lags 1 and 2: 0.18 and 0.278

respectively. These values are

actually not quite large enough in magnitude to be significant at the 0.05

level, although that is not a magical standard. (The critical value for this test is

roughly 2/SQRT(n), where n is the sample size, which is 0.28 in this case.) The appearance of the residual plot

rather than the values of the test statistics is the best diagnostic of the

time pattern here. Always look at

the pictures! (Return

to top of page.)

A linear trend in the errors of a

regression model can be addressed by including a time index variable (for example, the week-number variable in

this file) as another regressor. If

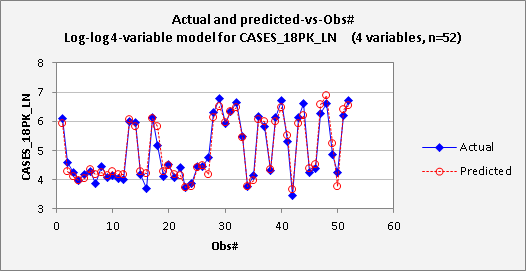

we do that here, we obtain the following 4-variable multiple regression model:

The

standard error of the regression has been further reduced by a meaningful

amount, from 0.281 to 0.244. The

coefficients of the original variables have wiggled around a bit, but are in the

same ballpark as before. The

coefficient of Week is significantly different from zero (t=4.079), and its

value of 0.011 appears to suggest that the average trend in sales of 18-packs

is about 1.1% per week. But

appearances can sometimes be deceiving:

in the context of a multiple

regression model, a trend variable adjusts for differences in trends among all

the variables, rather than measuring the trend in the dependent variable

alone. (Return

to top of page.)

The updated

plots are shown below. The

residual-vs-obs# plot now does not show any systematic time pattern, and the

autocorrelations that were previously seen in the errors have essentially

vanished.

Overall,

this appears to be a good model, and it has a lot to say about how sales of

18-packs are affected by price. The

additional take-aways from this step of the analysis are that:

·

There is significant cross-price elasticity in the data for

sales of 18-packs vs. prices of 12-packs and 30-packs.

·

The trend in sales of 18-packs is not entirely explained by

trends in price

·

This exercise has illustrated the construction of a linear

regression model by a series of logical steps, beginning with descriptive

analysis and proceeding through the fitting of a sequence of models that are

motivated by economic theory and by interpretation of patterns seen in the

statistical and graphical output.

This

is not quite the end of the story:

some final comments and another picture are given below.

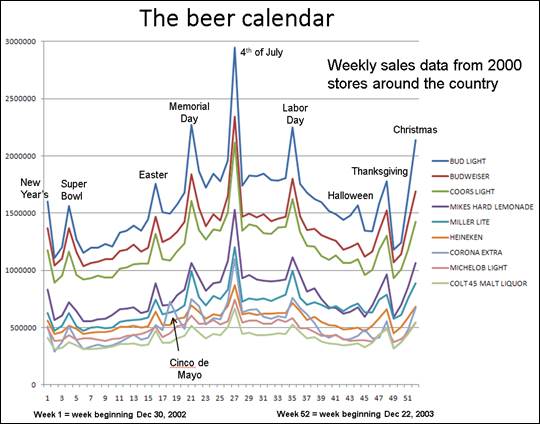

Postscript: this is real data, and one thing that is

a bit curious about it is that there is no evidence of seasonality. In general, beer sales in the U.S.

exhibit very significant seasonality, being higher in the hotter months and

having large spikes in certain holiday weeks. Here’s a picture of total weekly

sales of the top-selling brands at a much larger sample of stores: