Averaging and smoothing models

Averaging and smoothing models

Notes

on forecasting with moving averages (pdf)

Averaging and exponential

smoothing models

Slides

on inflation and seasonal adjustment and Winters seasonal exponential smoothing

Spreadsheet

implementation of seasonal adjustment and exponential smoothing

Equations

for the smoothing models (SAS web site)

Spreadsheet

implementation of seasonal adjustment and exponential smoothing

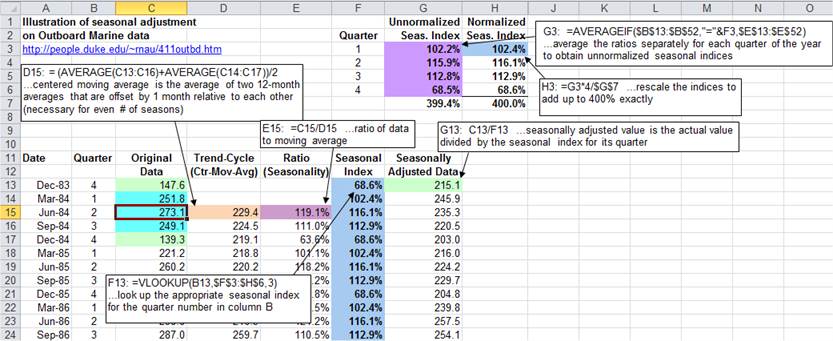

It is

straightforward to perform seasonal adjustment and fit exponential smoothing

models using Excel. The screen images and charts below are taken from a

spreadsheet which has been set up to illustrate multiplicative seasonal

adjustment and linear exponential smoothing on the following quarterly sales

data from Outboard Marine:

To obtain

a copy of the spreadsheet file itself, click here. The version of linear exponential

smoothing that will be used here for purposes of demonstration is Brown’s

version, merely because it can be implemented with a single column of formulas

and there is only one smoothing constant to optimize. Usually it is better to use Holt’s

version that has separate smoothing constants for level and trend.

The

forecasting process proceeds as follows: (i) first the data are seasonally

adjusted; (ii) then forecasts are generated for the seasonally adjusted data

via linear exponential smoothing; and (iii) finally the seasonally adjusted

forecasts are "reseasonalized" to obtain forecasts for the original

series. The seasonal adjustment process is carried out in columns D through G.

The first

step in seasonal adjustment is to compute a centered moving average

(performed here in column D). This can be done by taking the average of two

one-year-wide averages that are offset by one period relative to each other. (A

combination of two offset averages rather than a single average is needed for

centering purposes when the number of seasons is even.) The next step is to

compute the ratio to moving average--i.e., the original data divided by

the moving average in each period--which is performed here in column E. (This is also called the "trend-cycle"

component of the pattern, insofar as trend and business-cycle effects might be

considered to be all that remains after averaging over a whole year's worth of

data. Of course, month-to-month changes that are not due to seasonality could be

determined by many other factors, but the 12-month average smooths over them to

a great extent.) The

estimated seasonal index for each season is computed by first averaging

all the ratios for that particular season, which is done in cells G3-G6 using

an AVERAGEIF formula. The average

ratios are then rescaled so that they sum to exactly 100% times the number of

periods in a season, or 400% in this case, which is done in cells H3-H6.

Below in column F, VLOOKUP formulas are used to insert the appropriate seasonal

index value in each row of the data table, according to the quarter of the year

it represents. The centered

moving average and the seasonally adjusted data end up looking like this:

Note that

the moving average typically looks like a smoother version of the seasonally

adjusted series, and it is shorter on both ends.

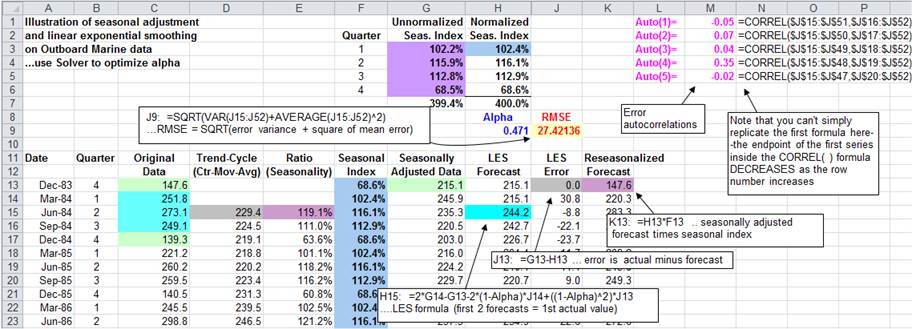

Another

worksheet in the same Excel file shows the

application of the linear exponential smoothing model to the seasonally

adjusted data, beginning in column G.

A value

for the smoothing constant (alpha) is entered above the forecast column (here,

in cell H9) and for convenience it is assigned the range name

"Alpha." (The name is assigned using the

"Insert/Name/Create" command.) The LES model is initialized by

setting the first two forecasts equal to the first actual value of the

seasonally adjusted series. The formula used here for the LES forecast is the

single-equation recursive form of Brown’s model:

![]()

This formula is entered in the cell corresponding to the third period (here,

cell H15) and copied down from there. Notice that the LES forecast for the

current period refers to the two preceding observations and the two

preceding forecast errors, as well as to the value of alpha. Thus, the

forecasting formula in row 15 refers only to data which were available in row

14 and earlier. (Of course, if we wished to use simple instead of linear

exponential smoothing, we could substitute the SES formula here instead. We could also use Holt’s rather

than Brown’s LES model, which would require two more columns of formulas

to calculate the level and trend that are used in the forecast.)

The errors

are computed in the next column (here, column J) by subtracting the forecasts

from the actual values. The root

mean squared error is computed as the square root of the variance of

the errors plus the square of the mean. (This follows from the mathematical

identity: MSE = VARIANCE(errors)+ (AVERAGE(errors))^2.) In calculating the mean

and variance of the errors in this formula, the first two periods are excluded

because the model does not actually begin forecasting until the third period

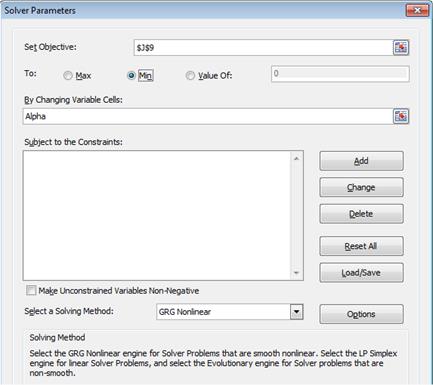

(row 15 on the spreadsheet). The optimal value of alpha can be found either by

manually changing alpha until the minimum RMSE is found, or else you can use

the "Solver" to perform an exact minimization. The value of alpha

that the Solver found is shown here (alpha=0.471).

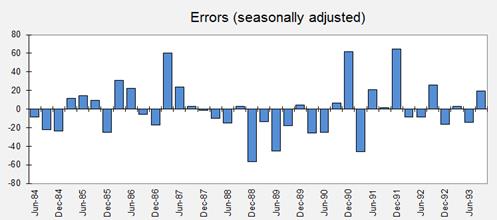

It is

usually a good idea to plot the errors of the model (in transformed units) and

also to compute and plot their autocorrelations at lags of up to one season.

Here is a time series plot of the (seasonally adjusted) errors:

The error

autocorrelations are computed by using the CORREL( ) function to compute the

correlations of the errors with themselves lagged by one or more periods--details

are shown in the spreadsheet model. Here is a plot of the autocorrelations of

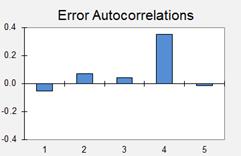

the errors at the first five lags:

The

autocorrelations at lags 1 to 3 are very close to zero, but the spike at lag 4

(whose value is 0.35) is slightly troublesome--it suggests that the seasonal

adjustment process has not been completely successful. However, it is actually

only marginally significant. 95%

significance bands for testing whether autocorrelations are significantly

different from zero are roughly plus-or-minus 2/SQRT(n-k), where n is the sample size

and k is the lag. Here n is 38 and k varies from 1 to 5, so the

square-root-of-n-minus-k is around 6 for all of them, and hence the limits for

testing the statistical significance of deviations from zero are roughly

plus-or-minus 2/6, or 0.33. If you vary the value of alpha by hand in this

Excel model, you can observe the effect on the time series and autocorrelation

plots of the errors, as well as on the root-mean-squared error, which will be

illustrated below.

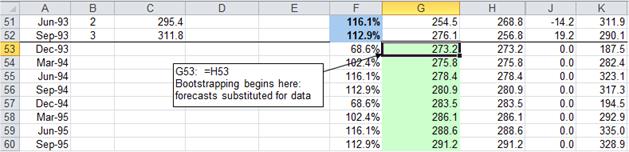

At the

bottom of the spreadsheet, the forecasting formula is "bootstrapped"

into the future by merely substituting forecasts for actual values at the point

where the actual data runs out--i.e., where "the future" begins. (In

other words, in each cell where a future data value would occur, a cell

reference is inserted which points to the forecast made for that

period.) All the other formulas are simply copied down from above:

Notice that

the errors for forecasts of the future are all computed to be zero.

This does not mean the actual errors will be zero, but rather it merely

reflects the fact that for purposes of prediction we are assuming that the

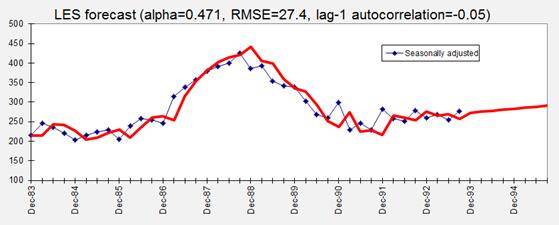

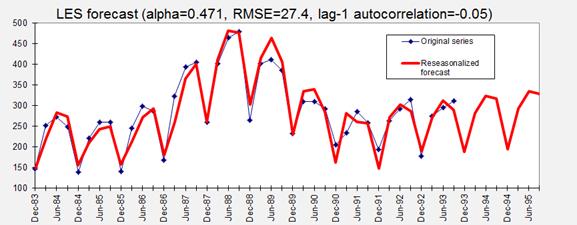

future data will equal the forecasts on average. The resulting LES

forecasts for the seasonally adjusted data look like this:

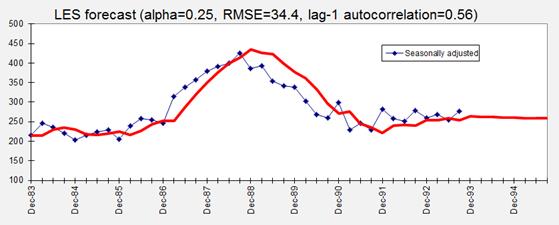

With this

particular value of alpha, which is optimal for one-period-ahead predictions,

the projected trend is slightly upward, reflecting the local trend that was

observed over the last 2 years or so. For other values of alpha, a very

different trend projection might be obtained. It is usually a good idea to see

what happens to the long-term trend projection when alpha is varied, because

the value that is best for short-term forecasting will not necessarily be the

best value for predicting the more distant future. For example, here is the

result that is obtained if the value of alpha is manually set to 0.25:

The

projected long-term trend is now negative rather than positive! With a smaller

value of alpha, the model is placing more weight on older data in its

estimation of the current level and trend, and its long-term forecasts reflect

the downward trend observed over the last 5 years rather than the more recent

upward trend. This chart also clearly illustrates how the model with a smaller

value of alpha is slower to respond to "turning points" in the data

and therefore tends to make an error of the same sign for many periods in a

row. Its 1-step-ahead forecast

errors are larger on average than those obtained before (RMSE of 34.4 rather

than 27.4) and strongly positively autocorrelated. The lag-1 autocorrelation of 0.56

greatly exceeds the value of 0.33 calculated above for a statistically

significant deviation from zero. As

an alternative to cranking down the value of alpha in order to introduce more

conservatism into long-term forecasts, a "trend dampening" factor is

sometimes added to the model in order to make the projected trend flatten out

after a few periods.

The final

step in building the forecasting model is to "reasonalize" the LES

forecasts by multiplying them by the appropriate seasonal indices. Thus, the

reseasonalized forecasts in column I are simply the product of the seasonal

indices in column F and the seasonally adjusted LES forecasts in column H.

It is

relatively easy to compute confidence intervals for one-step-ahead

forecasts made by this model: first compute the RMSE (root-mean-squared error,

which is just the square root of the MSE) and then compute a confidence

interval for the seasonally adjusted forecast by adding and subtracting

two times the RMSE. (In general a 95% confidence interval for a

one-period-ahead forecast is roughly equal to the point forecast

plus-or-minus-two times the estimated standard deviation of the forecast

errors, assuming the error distribution is approximately normal and the sample

size is large enough, say, 20 or more. Here, the RMSE rather than the

sample standard deviation of the errors is the best estimate of the standard

deviation of future forecast errors because it takes bias as well random

variations into account.) The confidence limits for the seasonally adjusted

forecast are then reseasonalized, along with the forecast, by

multiplying them by the appropriate seasonal indices. In this case the RMSE is

equal to 27.4 and the seasonally adjusted forecast for the first future

period (Dec-93) is 273.2, so the seasonally adjusted 95% confidence

interval is from 273.2-2*27.4 = 218.4 to 273.2+2*27.4 = 328.0.

Multiplying these limits by December's seasonal index of 68.61%, we

obtain lower and upper confidence limits of 149.8 and 225.0

around the Dec-93 point forecast of 187.4.

Confidence

limits for forecasts more than one period ahead will generally widen as the

forecast horizon increases, due to uncertainty about the level and trend as

well as the seasonal factors, but it is difficult to compute them in general by

analytic methods. (The appropriate way to compute confidence limits for

the LES forecast is by using ARIMA theory, but the uncertainty in the seasonal

indices is another matter.) If you want a realistic confidence interval

for a forecast more than one period ahead, taking all sources of error into

account, your best bet is to use empirical methods: for example, to obtain a

confidence interval for a 2-step ahead forecast, you could create another

column on the spreadsheet to compute a 2-step-ahead forecast for every period

(by bootstrapping the one-step-ahead forecast). Then compute the RMSE of the

2-step-ahead forecast errors and use this as the basis for a 2-step-ahead

confidence interval.