Principles and risks

of forecasting (pdf)

Famous

forecasting quotes

How to move data around

Get to know your data

Inflation adjustment

(deflation)

Seasonal adjustment

Stationarity and differencing

The logarithm transformation

Inflation adjustment

Inflation

adjustment,

or "deflation", is accomplished by dividing a monetary time series

by a price index, such as the Consumer Price Index (CPI). The

deflated series is then said to be measured in "constant dollars,"

whereas the original series was measured in "nominal dollars" or

"current dollars." Inflation is often a significant component of

apparent growth in any series measured in dollars (or yen, euros, pesos, etc.).

By adjusting for inflation, you uncover the real growth, if any.

You also may stabilize the variance of random or seasonal fluctuations and/or

highlight cyclical patterns in the data. Inflation-adjustment is not

always necessary when dealing with monetary variables--sometimes it is simpler

to forecast the data in nominal terms or to use a logarithm

transformation for stabilizing the variance--but it is an important tool in the

toolkit for analyzing economic data.

The Consumer

Price Index is probably the best known US price index, but other price indices

may be appropriate for some data. The Producer Price Index and the GDP

Implicit Price Deflator are some other commonly used indices, and numerous

industry-specific indices are also available. The U.S. Bureau of Economic

Analysis compiles a wide array of "chain-type" price indices for

various kinds of personal consumption goods. A chain-type index is one

that is obtained by chaining together monthly, quarterly, or annual changes in

relative prices that are adjusted for changes in the composition of the

commodity basket, so as to reflect changes in consumer tastes. (For more

details on chain-type indices, see the following article.)

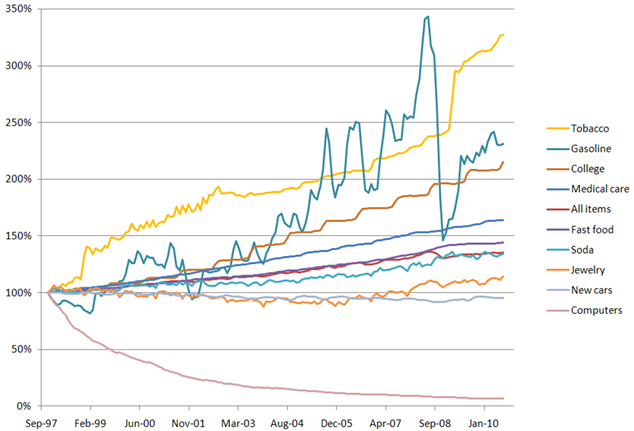

The

following chart shows price indices for a variety of products and services over

the period from 1997 to 2010, all scaled to a value of 100% in 1997. There are some striking

differences: the price of

gasoline has experienced large downward as well as upward movements due to

shocks to the world economy, tobacco prices have risen in large part due to taxation,

the price of a college education has gone up dramatically in stair-step

fashion, and the price of computers has shown an exponential decline rather than exponential

growth. (The ordering of the series

in the legend is the same as their rankings in 2010, except that the all-items

index should be ranked below rather than above fast food.)

Use of an

appropriate price index is important if you are interested in knowing the true

magnitudes of trends in real terms

and/or if the relevant price history has undergone sudden jumps or significant

changes in trend rather than consistent increases over time.

However, deflation by a general-purpose index such as the CPI is often adequate

for rough estimates of trends in real terms when doing exploratory data

analysis or when fitting a forecasting model that adapts to changing trends

anyway. Keep in mind that when you deflate a sales or consumer

expenditures series by a general index such as the CPI, you are not necessarily

converting from dollars spent to units sold or consumed, rather, you are

converting from dollars spent on one type of good to equivalent quantities of other

consumer goods (e.g., hamburgers and hot dogs) that could have been

purchased with the same money. Sometimes this is of interest in its own

right because it reveals growth in relative terms, compared to prices of other

goods.

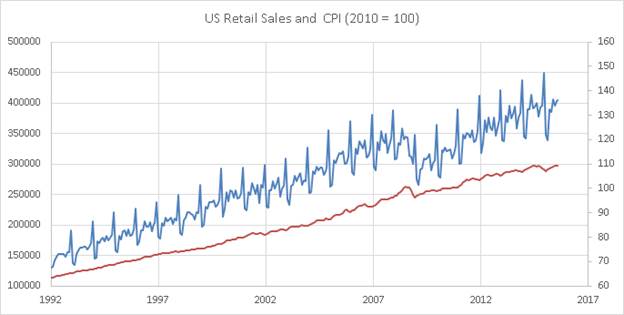

Here is the

graph of U.S. total retail sales in nominal dollars ($millions) plotted alongside the CPI for

the period from January 1992 to August 2015, where the CPI has been scaled

so that the average value in 2010 is 100:

Next, here

is a graph of retail sales divided by (i.e. deflated by) the CPI. The trend that remains is real growth. The seasonal pattern and the magnitude

of the drop in sales during the Great Recession stand out more clearly when

displayed in real terms:

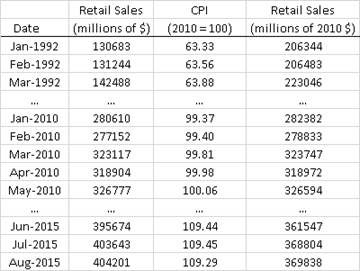

The

following screen shot of the spreadsheet shows how the process of adjusting the

retail sales to 2010 dollars was carried out here. The U.S. all-city-average CPI was

obtained from a public source (Economagic.com) and adjusted to 2010 dollars by

dividing it by the average 2010 value and then multiplying by 100. (It is conventional to scale it to a

value of 100 in the base year.) The

inflation-adjusted values were obtained by dividing the original sales values

by the 2010 CPI and then multiplying by 100. For example, 206344 = (130683/63.33)x100.

When looking

at descriptions of time series obtained from government or commercial data

sources, the identifier "$" or "dollars" means the series

is in nominal dollars (i.e., not inflation-adjusted). An

identifier such as "2010 dollars" or "2010 $" means that

the series is in constant (inflation-adjusted) dollars, with 2010 taken

as the reference point. For modeling purposes, the choice of a reference point

doesn't matter, since changing the reference point merely multiplies or divides

the whole series by a constant. To move the reference point to a different base

year, you would just divide the whole price index series by the current value

of the index at the desired reference date. However, the parameters of a model

are easier to interpret if the same reference point is used for all

inflation adjustments. The thing you wish to avoid at all costs is having some

variables which are inflation adjusted and others which aren't:

this will introduce apparent nonlinear relationships which are merely artifacts

of inconsistent units.

Finally, remember

that inflation adjustment is only appropriate for series which are measured in

units of money: if the series is measured in number of widgets produced or

hamburgers served or percent interest, it makes no sense to deflate. If a

non-monetary series nonetheless shows signs of exponential growth or increasing

variance, it may be useful to try a logarithm transformation

instead.

Go on to next topic: Seasonal adjustment