Principles and risks

of forecasting (pdf)

Famous forecasting

quotes

How to move data around

Get to know your data

Inflation adjustment (deflation)

Seasonal adjustment

Stationarity and differencing

The logarithm transformation

Seasonal adjustment

Multiplicative adjustment

Additive adjustment

Acronyms: SA, NSA, SAAR

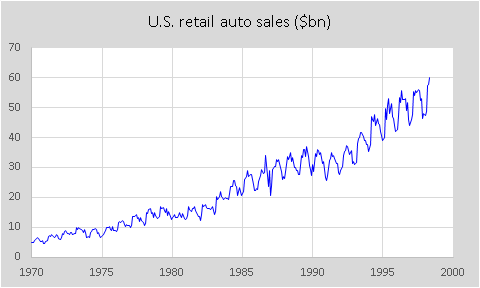

Multiplicative adjustment: Consider the graph of U.S. total retail sales of automobiles from January

1970 to May 1998, in units of billions of dollars, as reported at the time by

the U.S. Bureau of Economic Analysis:

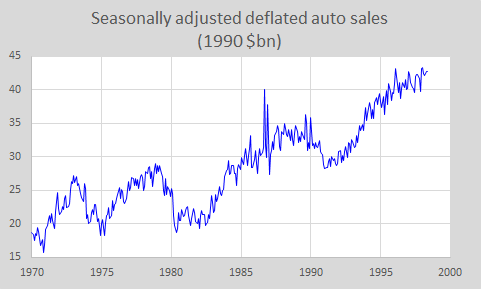

Much of the trend is merely due to inflation. The values can be deflated, i.e.,

converted to units of constant rather than nominal dollars, by dividing them by

a suitable price index scaled to a value of 1.0 in whatever year is desired as

the base year. Here’s the

result of dividing by the U.S. consumer price index (CPI) scaled to 1.0 in

1990, which converts the units to billions of 1990 dollars:

(The data

can be found in this Excel file, and it is

also analyzed in further detail in the pages on seasonal ARIMA models on this

site.) There is still a general

upward trend, and the increasing amplitude of seasonal variations is suggestive

of a multiplicative seasonal pattern: the seasonal effect expresses

itself in percentage terms, so the absolute magnitude of the seasonal variations

increases as the series grows over time. Such a pattern can be removed by multiplicative

seasonal adjustment, which is accomplished by dividing each value of

the time series by a seasonal index (a number in the vicinity of 1.0) that

represents the percentage of normal typically observed in that season.

For example,

if December's sales are typically 130% of the normal monthly value (based on

historical data), then each December's sales would be seasonally adjusted by

dividing by 1.3. Similarly, if January's sales are typically only 90% of

normal, then each January's sales would be seasonally adjusted by dividing by

0.9. Thus, December's value would be adjusted downward while January's would be

adjusted upward, correcting for the anticipated seasonal effect. Depending on

how they were estimated from the data, the seasonal indices might remain the

same from one year to the next, or they might vary slowly with time.

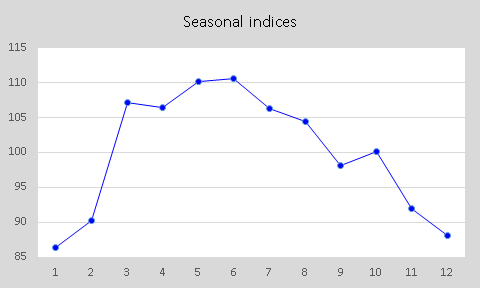

The seasonal

indices computed by the Seasonal Decomposition procedure in Statgraphics are

constant over time, and are computed via the so-called "ratio-to-moving

average method." (For an explanation of this method, see the slides

on forecasting with seasonal adjustment and the notes on spreadsheet implementation of seasonal adjustment.)

Here are the multiplicative seasonal indices for auto sales as computed by the

Seasonal Decomposition procedure in Statgraphics:

Finally,

here is the seasonally adjusted version of deflated auto sales that is obtained by

dividing each month's value by its estimated seasonal index:

Notice that

the pronounced seasonal pattern is gone, and what remains are the trend and

cyclical components of the data, plus random noise.

Additive

adjustment: As

an alternative to multiplicative seasonal adjustment, it is also possible to

perform additive seasonal adjustment. A time series whose seasonal

variations are roughly constant in magnitude, independent of the current

average level of the series, would be a candidate for additive seasonal

adjustment. In additive seasonal adjustment, each value of a time series is

adjusted by adding or subtracting a quantity that represents the

absolute amount by which the value in that season of the year tends to be below

or above normal, as estimated from past data.

Additive

seasonal patterns are somewhat rare in nature, but a series that has a natural

multiplicative seasonal pattern is converted to one with an additive seasonal

pattern by applying a logarithm transformation to the

original data. Therefore, if you are using seasonal adjustment in conjunction

with a logarithm transformation, you probably should use additive rather than

multiplicative seasonal adjustment. (In the Seasonal Decomposition and

Forecasting procedures in Statgraphics, you are given a choice between additive

and multiplicative seasonal adjustment.) (Return to top of

page.)

Acronyms: When examining the

descriptions of time series in Datadisk and other sources, the acronym SA

stands for "seasonally adjusted, whereas NSA stands for "not

seasonally adjusted. A seasonally adjusted annual rate (SAAR) is

a time series in which each period's value has been adjusted for seasonality

and then multiplied by the number of periods in a year, as though the same

value had been obtained in every period for a whole year. (Return

to top of page.)

Go on to next topic: Stationarity and differencing