5. 1 Emotional Value

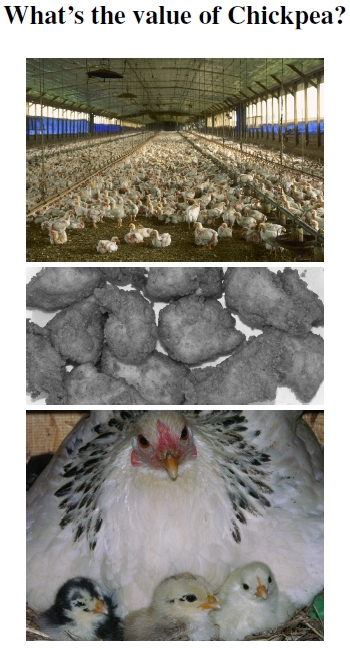

Figure 5.1: A chicken barn with chickens valued at $2.60 per bird (USDA Photo by Larry Rana), chicken as a market good with a value of 30 cents per nugget, and my family’s pet chicken, Chickpea, with infinite value to some family members. In one case, the chicken serves as a market good, and in the other, as an eggproducing pet. Similarly, privately owned pulp-producing forest trees only possess market value, but city trees can create positive feelings in citizens, thereby holding hard-to-measure nonmarket values.

What a difference a name makes. According to the USDA’s National Agricultural Statistics Services, about 453 million chickens lived in the United States in December 2006, each worth about $2.60. Many of these chickens ended up as value-added chicken nuggets, but Chickpea (Figure 5.1), one of my family’s backyard chickens, has a name. Even though she spends much of her time brooding, she’s a rather happy chicken that my children love, and she recently served as a surrogate mom. Now getting on a bit in age, and really quite small, she wouldn’t make much of a meal. And, of course, I’d have some very unhappy children (and spouse) if Chickpea ever ended up on the table. My family highly values Chickpea as something like a pet, making its possession of a name a matter of life or death.[1]

These feelings for Chickpea represent nonmarket goods. True, when laying, she provides an egg a day or two, making her a pet with benefits, something like two or three dollars for very free-range eggs every couple of weeks. Yet her life remains secure even if she stopped laying eggs. Having kids learn to take care of animals also has value, but it’s not a market good either.

As with all market goods, we can readily understand why a grocer might get upset if a customer comes in and eats a handful of grapes, an apple, then finishes the tasting off with some orange juice, and walks out of the store without paying. These stolen items are goods paid for and owned by the grocer. Now imagine driving out in the country enjoying the views of pastures with horses, farmsteads with barns, and forested land. The farmer or rancher owns it, pays taxes, and works hard to keep it all in shape, but the travelers enjoy a free passive value in experiencing and enjoying the viewshed. Certainly the landowner loses no market value from these passive uses. However, city dwellers and suburbanites get upset when they’re denied this nonmarket good they’ve taken for granted because the 70-year-old landowner decides to retire (perhaps because of a debilitating illness) and cash out the market value of the property for development. Who has rights to the view of a privately owned property, and should they pay for that view?[2]

Building personal emotional connections between a person or a group of people and the environment can help with its protection, for example, Adopt-a-Stream, Park, Garden, or tree-planting and gardening programs in urban areas. These protective connections, like that brought about by my family’s feelings toward Chickpea and her flock-mates, reflect a value determined by a process called contingent valuation. There are several fine introductions to the contingent valuation of nonmarket goods, covering both pros and cons.[3] Conserving land for wildlife relies on these concepts to make arguments against converting land into economically viable housing developments, landfills, or stripmines.[4]

———————————–

[1]Sadly, her name did not protect her from a tragic “accident” involving our dog.

[2]Are we willing to pay for this nonmarket good through increased taxes to support the landowner in his or her retirement, not to mention shoulder the start-up costs for new farmers? In fact, there exist federal programs that buy farmland conservation easements. These programs buy the development rights of farmland from the landowners. This purchase lowers the land’s value, provides the landowner some money in return, and sometimes involves a requirement that the land be farmed in perpetuity (see, for example, www.nrcs.usda.gov/programs/frpp).

[3]Hanemann (1994) and Carson et al. (2001) provide introductions to contingent valuation. Another important, detailed example is the economic value of water (Hanemann 2006).

[4]An example of Carson et al. (2001) compares turning a parcel of land into a stripmine versus a closed wildlife reserve.