ARIMA models for time

series forecasting

ARIMA models for time

series forecasting

Notes

on nonseasonal ARIMA models (pdf file)

Slides on seasonal and

nonseasonal ARIMA models (pdf file)

Introduction

to ARIMA: nonseasonal models

Identifying the order of differencing in an ARIMA model

Identifying the numbers of AR or MA terms in an ARIMA

model

Estimation of ARIMA models

Seasonal differencing in ARIMA models

Seasonal random walk: ARIMA(0,0,0)x(0,1,0)

Seasonal random trend: ARIMA(0,1,0)x(0,1,0)

General seasonal models: ARIMA (0,1,1)x(0,1,1) etc.

Summary of rules for identifying ARIMA models

ARIMA models with regressors

The

mathematical structure of ARIMA models (pdf file)

General seasonal ARIMA

models: (0,1,1)x(0,1,1) etc.

Outline of seasonal ARIMA modeling

Example: AUTOSALE series revisited

The often-used ARIMA(0,1,1)x(0,1,1) model: SRT model plus

MA(1) and SMA(1) terms

The ARIMA(1,0,0)x(0,1,0) model with constant: SRW model plus

AR(1) term

An improved version: ARIMA(1,0,1)x(0,1,1) with constant

Seasonal ARIMA versus exponential smoothing and seasonal

adjustment

What are the tradeoffs among the various seasonal models?

To log or not to log?

Data files:

Excel file with auto sales data

Statgraphics data and

model files (zip)

Outline

of seasonal ARIMA modeling:

- The

seasonal part of an ARIMA model has the same structure as the non-seasonal

part: it may have an AR factor, an MA factor, and/or an order of

differencing. In the seasonal part of the model, all of these factors

operate across multiples of lag s (the number of periods in a

season).

- A

seasonal ARIMA model is classified as an ARIMA(p,d,q)x(P,D,Q)

model, where P=number of seasonal autoregressive (SAR) terms, D=number of

seasonal differences, Q=number of seasonal moving average (SMA) terms

- In

identifying a seasonal model, the first step is to determine

whether or not a seasonal difference is needed, in addition to or

perhaps instead of a non-seasonal difference. You should look at time

series plots and ACF and PACF plots for all possible combinations of 0 or

1 non-seasonal difference and 0 or 1 seasonal difference. Caution:

don't EVER use more than ONE seasonal difference, nor more than TWO total

differences (seasonal and non-seasonal combined).

- If

the seasonal pattern is both strong and stable over time

(e.g., high in the Summer and low in the Winter, or vice versa), then you

probably should use a seasonal difference regardless of whether you

use a non-seasonal difference, since this will prevent the seasonal

pattern from "dying out" in the long-term forecasts. Let's add

this to our list of rules for identifying models

Rule 12: If the series has a strong and consistent seasonal pattern, then you should use an order of seasonal differencing--but never use more than one order of seasonal differencing or more than 2 orders of total differencing (seasonal+nonseasonal).

- The

signature of pure SAR or pure SMA behavior is similar to the

signature of pure AR or pure MA behavior, except that the pattern appears

across multiples of lag s in the ACF and PACF.

- For

example, a pure SAR(1) process has spikes in the ACF at lags s, 2s, 3s,

etc., while the PACF cuts off after lag s.

- Conversely,

a pure SMA(1) process has spikes in the PACF at lags s, 2s, 3s, etc.,

while the ACF cuts off after lag s.

- An

SAR signature usually occurs when the autocorrelation at the seasonal

period is positive, whereas an SMA signature usually occurs when

the seasonal autocorrelation is negative, hence:

Rule 13: If the autocorrelation at the seasonal period is positive, consider adding an SAR term to the model. If the autocorrelation at the seasonal period is negative, consider adding an SMA term to the model. Try to avoid mixing SAR and SMA terms in the same model, and avoid using more than one of either kind.

- Usually

an SAR(1) or SMA(1) term is sufficient. You will rarely encounter a

genuine SAR(2) or SMA(2) process, and even more rarely have enough data to

estimate 2 or more seasonal coefficients without the estimation algorithm

getting into a "feedback loop."

- Although

a seasonal ARIMA model seems to have only a few parameters, remember that

backforecasting requires the estimation of one or two seasons' worth of

implicit parameters to initialize it. Therefore, you should have at least

4 or 5 seasons of data to fit a seasonal ARIMA model.

- Probably

the most commonly used seasonal ARIMA model is the (0,1,1)x(0,1,1)

model--i.e., an MA(1)xSMA(1) model with both a seasonal and a non-seasonal

difference. This is essentially a "seasonal exponential

smoothing" model.

- When

seasonal ARIMA models are fitted to logged data, they are capable

of tracking a multiplicative seasonal pattern.

Example:

AUTOSALE series revisited

Recall that we

previously forecast the retail auto sales series by using

a combination of deflation, seasonal adjustment and exponential smoothing. Let's now try fitting the same series with

seasonal ARIMA models, using the same sample of data from January 1970 to May

1993 (281 observations). As before we will work with deflated auto

sales--i.e., we will use the series AUTOSALE/CPI as the input variable. Here

are the time series plot and ACF and PACF plots of the original series, which

are obtained in the Forecasting procedure by plotting the "residuals"

of an ARIMA(0,0,0)x(0,0,0) model with constant:

The

"suspension bridge" pattern in the ACF is typical of a series that is

both nonstationary and strongly seasonal. Clearly we need at least one order of

differencing. If we take a nonseasonal difference, the corresponding plots are

as follows:

The

differenced series (the residuals of a random-walk-with-growth model) looks

more-or-less stationary, but there is still very strong autocorrelation at the

seasonal period (lag 12).

Because the

seasonal pattern is strong and stable, we know (from Rule 12) that we will want

to use an order of seasonal differencing in the model. Here is what the

picture looks like after a seasonal difference (only):

The

seasonally differenced series shows a very strong pattern of positive

autocorrelation, as we recall from our earlier attempt to fit a seasonal random walk model. This could be an "AR

signature"--or it could signal the need for another difference.

If we take

both a seasonal and nonseasonal difference, following results are obtained:

These are,

of course, the residuals from the seasonal random trend

model that we fitted to the auto sales data earlier. We now see the

telltale signs of mild overdifferencing: the positive spikes in the ACF

and PACF have become negative.

What is the

correct order of differencing? One more piece of information that might be

helpful is a calculation of the error statistics of the series at each

level of differencing. We can compute

these by fitting the corresponding ARIMA models in which only differencing is

used:

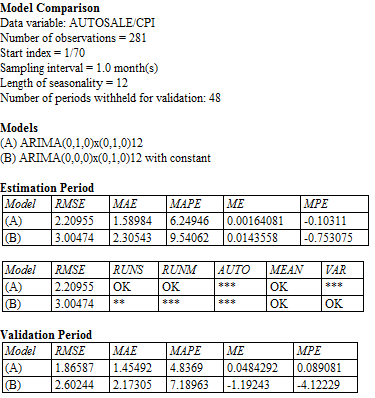

The smallest errors,

in both the estimation period and validation period, are obtained by model A,

which uses one difference of each type. This, together with the appearance of

the plots above, strongly suggests that we should use both a seasonal and a

nonseasonal difference. Note that, except for the gratuitious constant term,

model A is the seasonal random trend (SRT) model, whereas model B is just the

seasonal random walk (SRW) model. As we noted earlier when comparing these

models, the SRT model appears to fit better than the SRW model. In the analysis

that follows, we will try to improve these models through the addition of

seasonal ARIMA terms. Return to top of page.

The

often-used ARIMA(0,1,1)x(0,1,1) model: SRT model plus MA(1) and SMA(1) terms

Returning to the last

set of plots above, notice that with one

difference of each type there is a negative spike in the ACF at lag 1 and also

a negative spike in the ACF at lag 12, whereas the PACF shows a more

gradual "decay" pattern in the vicinity of both these lags. By

applying our rules for identifying ARIMA models

(specifically, Rule 7 and Rule 13), we may now conclude that the SRT model

would be improved by the addition of an MA(1) term and also an SMA(1) term.

Also, by Rule 5, we exclude the constant since two orders of

differencing are involved. If we do all this, we obtain the ARIMA(0,1,1)x(0,1,1) model, which is the most commonly used seasonal ARIMA model. Its forecasting equation is:

Ŷt =

Yt-12 + Yt-1 – Yt-13 - θ1et-1 – Θ1et-12 + θ1Θ1et-13

where θ1 is the MA(1)

coefficient and Θ1 (capital

theta-1) is the SMA(1) coefficient. Notice that this is just the seasonal

random trend model fancied-up by adding multiples of the errors at lags 1, 12,

and 13. Also, notice that the coefficient of the lag-13 error is the product of

the MA(1) and SMA(1) coefficients. This

model is conceptually similar to the Winters model insofar as it effectively

applies exponential smoothing to level, trend, and seasonality all at once,

although it rests on more solid theoretical foundations, particularly with

regard to calculating confidence intervals for long-term forecasts.

Its residual plots in

this case are as follows:

Although a slight amount of autocorrelation remains at lag 12, the overall appearance of the plots is good. The model fitting results show that the estimated MA(1) and SMA(1) coefficients (obtained after 7 iterations) are indeed significant:

The forecasts from

the model resemble those of the seasonal random trend model--i.e., they pick up

the seasonal pattern and the local trend at the end of the series--but they are

slightly smoother in appearance since both the seasonal pattern and the trend

are effectively being averaged (in a exponential-smoothing kind of way) over

the last few seasons:

What is this model really doing? You can think of it in the following

way. First it computes the difference

between each month’s value and an “exponentially weighted historical

average” for that month that is computed by applying exponential

smoothing to values that were observed in the same month in previous years, where

the amount of smoothing is determined by the SMA(1) coefficient. Then it applies simple exponential

smoothing to these differences in order to predict the deviation from the

historical average that will be observed next month. The value of the SMA(1) coefficient near

1.0 suggests that many seasons of data are being used to calculate the historical

average for a given month of the year. Recall that an MA(1) coefficient in an

ARIMA(0,1,1) model corresponds to 1-minus-alpha in the corresponding

exponential smoothing model, and that the average age of the data in an

exponential smoothing model forecast is 1/alpha. The SMA(1) coefficient has a

similar interpretation with respect to averages across seasons. Here its value of 0.91 suggests that the

average age of the data used for estimating the historical seasonal pattern is a

little more than 10 years (nearly half the length of the data set), which means

that an almost constant seasonal pattern is being assumed. The much smaller value of 0.5 for the

MA(1) coefficient suggests that relatively little smoothing is being done to

estimate the current deviation from the historical average for the same month,

so next month’s predicted deviation from its historical average will be

close to the deviations from the historical average that were observed over the

last few months.

The

ARIMA(1,0,0)x(0,1,0) model with constant: SRW model plus AR(1) term

The previous model

was a Seasonal Random Trend (SRT) model fine-tuned by the addition of MA(1) and

SMA(1) coefficients. An alternative ARIMA model for this series can be obtained

by substituting an AR(1) term for the nonseasonal difference--i.e., by adding

an AR(1) term to the Seasonal Random Walk (SRW) model. This will allow us to

preserve the seasonal pattern in the model while lowering the total amount of

differencing, thereby increasing the stability of the trend projections if

desired. (Recall that with one seasonal difference alone, the series did show a

strong AR(1) signature.) If we do this, we obtain an ARIMA(1,0,0)x(0,1,0) model

with constant, which yields the following results:

The AR(1) coefficient

is indeed highly significant, and the RMSE is only 2.06, compared to 3.00 for

the SRW model (Model B in the comparison report above). The forecasting

equation for this model is:

Ŷt =

μ + Yt-12 + ϕ1(Yt-1 - Yt-13)

The additional term

on the right-hand-side is a multiple of the seasonal difference observed in the

last month, which has the effect of correcting the forecast for the effect of

an unusually good or bad year. Here ϕ1 denotes the AR(1)

coefficient, whose estimated value is 0.73. Thus, for example, if sales last

month were X dollars ahead of sales one year earlier, then the quantity 0.73X

would be added to the forecast for this month. μ denotes

the CONSTANT in the forecasting

equation, whose estimated value is 0.20.

The estimated MEAN, whose value is 0.75, is the mean value of the

seasonally differenced series, which is the annual trend in the long-term

forecasts of this model. The

constant is (by definition) equal to the mean times 1 minus the AR(1)

coefficient: 0.2 = 0.75*(1 –

0.73).

The forecast plot

shows that the model indeed does a better job than the SRW model of tracking

cyclical changes (i.e., unusually good or bad years):

However, the MSE for

this model is still significantly larger than what we obtained for the

ARIMA(0,1,1)x(0,1,1) model. If we look at the plots of residuals, we see room

for improvement. The residuals still show some sign of cyclical variation:

The ACF and PACF suggest

the need for both MA(1) and SMA(1) coefficients:

An

improved version: ARIMA(1,0,1)x(0,1,1) with constant

If we add the

indicated MA(1) and SMA(1) terms to the preceding model, we obtain an ARIMA(1,0,1)x(0,1,1)

model with constant, whose forecasting equation is

Ŷt =

μ + Yt-12 + ϕ1(Yt-1 – Yt-13) - θ1et-1 – Θ1et-12 + θ1Θ1et-13

This is nearly the same as the ARIMA(0,1,1)x(0,1,1) model

except that it replaces the nonseasonal difference with an AR(1) term (a

"partial difference") and it incorporates a constant term

representing the long-term trend.

Hence,

this model assumes a more stable trend than the ARIMA(0,1,1)x(0,1,1) model, and

that is the principal difference between them.

The model-fitting results are as follows:

Notice that the

estimated AR(1) coefficient (ϕ1 in the model equation) is 0.96, which

is very close to 1.0 but not so close as to suggest that it absolutely ought to

be replaced with a first difference:

its standard error is 0.02, so it is about 2 standard errors from

1.0. The other statistics of the

model (the estimated MA(1) and SMA(1) coefficients and error statistics in the

estimation and validation periods) are otherwise nearly identical to those of

the ARIMA(0,1,1)x(0,1,1) model. (The estimated MA(1) and SMA(1) coefficients

are 0.45 and 0.91 in this model vs. 0.48 and 0.91 in the other.)

The estimated MEAN of

0.68 is the predicted long-term trend (average annual increase). This is essentially the same value that was

obtained in the (1,0,0)x(0,1,0)-with-constant model. The standard error of the

estimated mean is 0.26, so the difference between 0.75 and 0.68 is not

significant.

If the constant was not included in this model, it would

be a damped-trend model: the trend

in its very-long-term forecasts would gradually flatten out.

The point forecasts

from this model look quite similar to those of the (0,1,1)x(0,1,1) model,

because the average trend is similar to the local trend at the end of the

series. However, the confidence intervals for this model widen somewhat less

rapidly because of its assumption that the trend is stable. Notice that the

confidence limits for the two-year-ahead forecasts now stay within the

horizontal grid lines at 24 and 44, whereas those of the (0,1,1)x(0,1,1) model

did not:

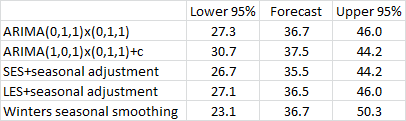

Seasonal

ARIMA versus exponential smoothing and seasonal adjustment: Now let's compare the

performance the two best ARIMA models against simple and linear exponential

smoothing models accompanied by multiplicative seasonal adjustment, and the

Winters model, as shown in the slides

on forecasting with seasonal adjustment:

The error statistics

for the one-period-ahead forecasts for all the models are extremely close in

this case. It is hard to pick a

“winner” based on these numbers alone. Return to top of page.

What

are the tradeoffs among the various seasonal models? The three models that

use multiplicative seasonal adjustment deal with seasonality in an explicit

fashion--i.e., seasonal indices are broken out as an explicit part of the

model. The ARIMA models deal with

seasonality in a more implicit manner--we can't easily see in the ARIMA output

how the average December, say, differs from the average July. Depending on

whether it is deemed important to isolate the seasonal pattern, this might be a

factor in choosing among models. The ARIMA models have the advantage that, once

they have been initialized, they have fewer "moving parts" than the

exponential smoothing and adjustment models and as such they may be less likely

to overfit the data. ARIMA models

also have a more solid underlying theory with respect to the calculation of

confidence intervals for longer-horizon forecasts than do the other models.

There are more

dramatic differences among the models with respect to the behavior of their

forecasts and confidence intervals for forecasts more than 1 period into the

future. This is where the

assumptions that are made with

respect to changes in the trend and seasonal pattern are very important.

Between the two ARIMA

models, one (model A) estimates a time-varying trend, while the other (model B)

incorporates a long-term average trend. (We could, if we desired, flatten out

the long-term trend in model B by suppressing the constant term.) Among the

exponential-smoothing-plus-adjustment models, one (model C) assumes a flat

trend, while the other (model D) assumes a time-varying trend. The Winters model (E) also assumes a

time-varying trend.

Models that assume a

constant trend are relatively more confident in their long-term forecasts than

models that do not, and this will usually be reflected in the extent to which

confidence intervals for forecasts get wider at longer forecast horizons. Models that do not assume time-varying

trends generally have narrower confidence intervals for longer-horizon

forecasts, but narrower is not better unless this assumption is correct.

The two exponential

smoothing models combined with seasonal adjustment assume that the seasonal

pattern has remained constant over the 23 years in the data sample, while the

other three models do not. Insofar

as the seasonal pattern accounts for most of the month-to-month variation in

the data, getting it right is important for forecasting what will happen

several months into the future. If

the seasonal pattern is believed to have changed slowly over time, another

approach would be to just use a shorter data history for fitting the models

that estimate fixed seasonal indices.

For the record, here

are the forecasts and 95% confidence limits for May 1995 (24 months ahead)

that are produced by the five

models:

The point forecasts

are actually surprisingly close to each other, relative to the widths of all

the confidence intervals. The SES point forecast is the lowest, because it is

the only model that does not assume an upward trend at the end of the

series. The ARIMA

(1,0,1)x(0,1,1)+c model has the narrowest confidence limits, because it assumes

less time-variation in the parameters than the other models. Also, its point

forecast is slightly larger than those of the other models, because it is

extrapolating a long-term trend rather than a short-term trend (or zero

trend).

The Winters model is

the least stable of the models and its forecast therefore has the widest

confidence limits, as was apparent in the detailed forecast plots for the

models. And the forecasts and

confidence limits of the ARIMA(0,1,1)x(0,1,1) model and those of the

LES+seasonal adjustment model are virtually identical!

To

log or not to log? Something

that we have not yet done, but might have, is include a log transformation as

part of the model. Seasonal ARIMA models are inherently additive models,

so if we want to capture a multiplicative seasonal pattern, we must do

so by logging the data prior to fitting the ARIMA model. (In Statgraphics, we

would just have to specify "Natural Log" as a modeling option--no big

deal.) In this case, the deflation transformation seems to have done a

satisfactory job of stabilizing the amplitudes of the seasonal cycles, so there

does not appear to be a compelling reason to add a log transformation as far as

long term trends are concerned. If the residuals showed a marked increase in

variance over time, we might decide otherwise.

There is still a

question of whether the errors of these models have a consistent variance across months of the year. If they don’t, then confidence

intervals for forecasts might tend to be too wide or too narrow according to

the season. The residual-vs-time

plots do not show an obvious problem in this regard, but to be thorough, it

would be good to look at the error variance by month. If there is indeed a problem, a log

transformation might fix it. Return to top of page.

Go on to next topic: summary of rules for identifying ARIMA models