Notes on linear

regression analysis (pdf file)

Introduction

to linear regression analysis

Mathematics

of simple regression

Regression examples

·

Beer sales vs.

price, part 1: descriptive analysis

·

Beer sales vs. price, part 2: fitting a simple

model

·

Beer sales vs. price, part 3: transformations

of variables

·

Beer sales vs. price, part 4: additional predictors

·

NC natural gas

consumption vs. temperature

·

More regression datasets

at regressit.com

What to look for in

regression output

What’s a good

value for R-squared?

What's the bottom line? How to compare models

Testing the assumptions of linear regression

Additional notes on regression

analysis

Stepwise and all-possible-regressions

Excel file with

simple regression formulas

Excel file with regression

formulas in matrix form

Notes on logistic regression (new!)

If you use

Excel in your work or in your teaching to any extent, you should check out the latest

release of RegressIt, a free Excel add-in for linear and logistic regression.

See it at regressit.com. The linear regression version runs on both PC's and Macs and

has a richer and easier-to-use interface and much better designed output than

other add-ins for statistical analysis. It may make a good complement if not a

substitute for whatever regression software you are currently using,

Excel-based or otherwise. RegressIt is an excellent tool for interactive

presentations, online teaching of regression, and development of videos of

examples of regression modeling. It includes extensive built-in

documentation and pop-up teaching notes as well as some novel features to

support systematic grading and auditing of student work on a large scale. There

is a separate logistic

regression version with

highly interactive tables and charts that runs on PC's. RegressIt also now

includes a two-way

interface with R that allows

you to run linear and logistic regression models in R without writing any code

whatsoever.

If you have

been using Excel's own Data Analysis add-in for regression (Analysis Toolpak),

this is the time to stop. It has not

changed since it was first introduced in 1993, and it was a poor design even

then. It's a toy (a clumsy one at that), not a tool for serious work. Visit

this page for a discussion: What's wrong with Excel's Analysis Toolpak for regression

Regression

example, part 1: descriptive

analysis

Any

regression analysis (or any sort of statistical analysis, for that matter)

ought to begin with a careful look at the raw material: the data. Where did it come from, how was it

measured, is it clean or dirty, how many observations are available, what are

the units, what are typical magnitudes and ranges of the values, and very

importantly, what do the variables look

like? Much of your brain is

devoted to the processing of visual information, and failure to engage that

part of your brain is like shooting in the dark. Visual analysis helps you to

identify systematic patterns as well as unusual events and data errors.

The

objective of this analysis will be to explain

and predict how the quantity of weekly sales of a popular brand of beer depends

on its price at a small chain of supermarkets. The data file contains 52

weeks of average-price and total-sales records for three different carton

sizes: 12-packs, 18-packs, and

30-packs. (This is real data, apart

from some very minor adjustments for the 30-packs.) One of the first things to consider in

assembling a data set for regression analysis is the choice of units (i.e., scaling) for the

variables. At the end of the day

you will be looking at error measures that are expressed in the units of the

dependent variable, and the model coefficients will be measured in units of

predicted change in the dependent variable per unit of change in the

independent variable. Ideally these

numbers should scaled in a way that makes them easy to

read and easy to interpret and compare.

In this analysis, the price and

sales variables have already been converted to a per-case (i.e., per-24-can)

basis, so that relative sales volumes for different carton sizes are

directly comparable and so that regression coefficients are directly comparable

for models fitted to data for different carton sizes. The first few rows of the data set (in

an Excel file) look like this:

The column

headings were chosen to be suitable as descriptive variable names for the

analysis. The value of 19.98 for

PRICE_12PK in week 1 means that 24 cans of beer cost $19.98 when purchased in

12 packs that week (i.e., the price of a single 12-pack was $9.99), and the

value of 223.5 for CASES_12PK means that 447 12-packs were sold (because a case

is two 12-packs).

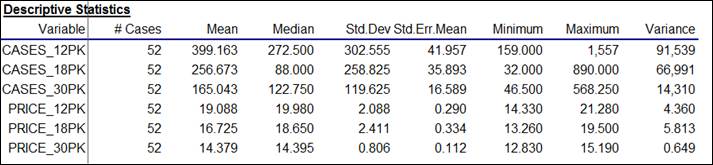

Let’s

begin with a look at the descriptive statistics, which show typical magnitudes

and the ranges of the variables:

Here it is seen that sales volume (measured in comparable units of cases)

was greater for the smaller carton sizes

(399 cases’ worth of 12-packs vs. 165 for 30-packs, with 18-packs

in the middle), while the average price-per-case was significantly smaller for

the larger carton sizes ($14.38 per case on average for 30-packs, vs. $19.09

per case for 12-packs, with 18-packs again in the middle). However, there was considerable

variation in prices of each carton size, as shown by the minimum and maximum

values.

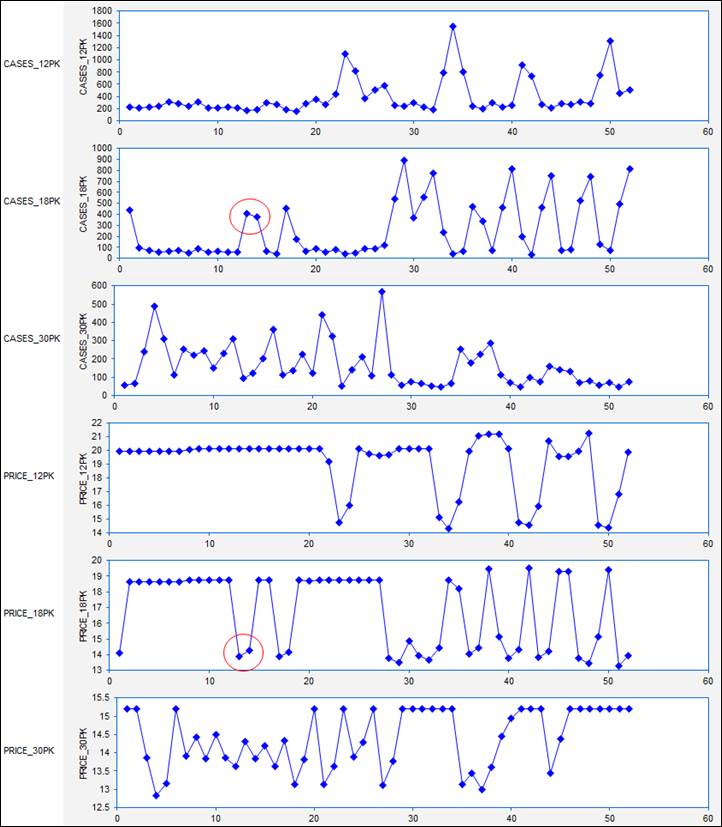

Because these are time series variables, it is vitally important to look

at their time series plots, as shown

below. (Actually, you should look

at plots of your variables versus row number even if they are not time series You never know what you might see. For non-time series data, you would not

want to draw connecting lines between the dots, however.) What stands out clearly in these plots

is that (as beer buyers will attest) the prices of different carton sizes are

systematically manipulated from week to week over a wide range, and there are

spikes in sales in weeks where there are price cuts. For example, there was deep cut in the

price of 18-packs in weeks 13 and 14, and a corresponding large increase in

sales in those two weeks. In fact,

if you look at all the cases-sold plots, you can see that sales volume for

every carton size is rather low unless

its price is cut in a given week.

(High-volume beer drinkers are very price-sensitive.) Another thing that stands out is the pattern of price manipulation was not

the same for all the carton sizes:

prices of 12-packs were not manipulated very often, whereas prices of

30-packs were manipulated on an almost week-to-week basis in the first half of

the year, and prices of 18-packs were more frequently manipulated in the second

half of the year. So, at this point

we have a pretty good idea of what the qualitative patterns are in weekly

prices and sales.

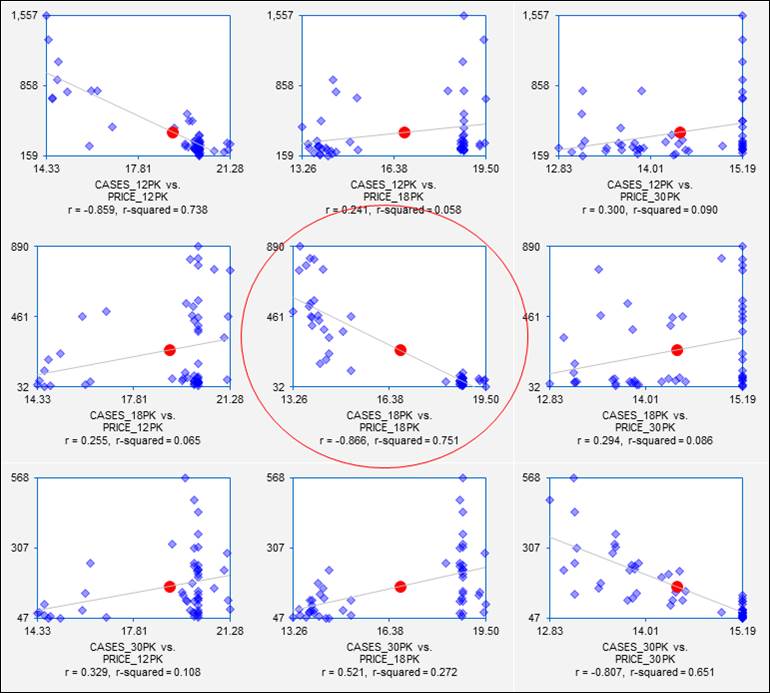

If our goal is to measure the price-demand relationships by fitting

regression models, we are also very interested in the correlations among the

variables and in the appearance of their scatterplots. Here is the correlation matrix, i.e., the table of all pairwise correlations

among the variables. (Remember that

the correlation between two variables is a statistic that measures the relative strength

of the linear relationship between them, on a scale of -1 to +1.) What stands out clearly here is that (as

we already knew from looking at the time series plots) there are very strong, negative correlations between price and sales

for all three carton sizes (greater than 0.8 in magnitude, as it turns

out), which are measures of “the price elasticity of demand.” There are also some weaker positive

correlations between the price of one carton size and sales of another--for

example, a correlation of 0.521 between price of 18-packs and sales of

30-packs. These are measures of

“cross-price elasticities”, i.e., substitution effects. Consumers tend to buy fewer 30-packs

when the price of 18-packs is reduced, presumably because they buy 18-packs

instead.

Last but not least, we should look at the scatterplot matrix of the variables, i.e., the matrix of all 2-way

scatterplots. The scatterplot

matrix is the visual counterpart of the correlation matrix, and it should

always be studied as a prelude to regression analysis if there are many

variables. (Virtually all commercial

regression software offers this feature, although the results vary a lot in

terms of graphical quality. The

ones produced by RegressIt, which are shown here, optionally include the

regression line, center-of-mass point, correlation, and squared correlation,

and each separate chart can be edited.) The full scatterplot matrix for

these variables is a 6x6 array, but we are especially interested in the 3x3

submatrix of scatterplots in which sales volume is plotted vs. price for

different combinations of carton sizes:

Each of these plots shows not only the price-demand relationship for sales

of one carton size vs. price of another, but it also gives a preview of the

results that will be obtained if a simple regression model is fitted. On the pages that follow,

regression models will be fitted to the sales data for 18-packs. From the scatterplot in the center of

the matrix, we already know a lot about the results we will get if we regress

sales of 18-packs on price of 18-packs.

Some “red flags” are already waving at this point,

though. The price-demand

relationships are quite strong, but the variance of sales is not consistent

over the full range of prices in any of these plots.

Go on to next step: interpreting simple regression output

By the way, all of the output shown above was generated at one time on a

single Excel worksheet with a few keystrokes using the Data Analysis procedure

in RegressIt, as shown below.

Hopefully your software will make this relatively easy too.