Notes on linear

regression analysis (pdf file)

Introduction

to linear regression analysis

Mathematics

of simple regression

Regression examples

·

Beer sales vs. price, part 1: descriptive

analysis

·

Beer sales vs.

price, part 2: fitting a simple model

·

Beer sales vs. price, part 3: transformations

of variables

·

Beer sales vs.

price, part 4: additional predictors

·

NC natural gas

consumption vs. temperature

·

More regression datasets

at regressit.com

What to look for in

regression output

What’s a good

value for R-squared?

What's the bottom line? How to compare models

Testing the assumptions of linear regression

Additional notes on regression

analysis

Stepwise and all-possible-regressions

Excel file with

simple regression formulas

Excel file with regression

formulas in matrix form

Notes on logistic regression (new!)

If you use

Excel in your work or in your teaching to any extent, you should check out the latest

release of RegressIt, a free Excel add-in for linear and logistic regression.

See it at regressit.com. The linear regression version runs on both PC's and Macs and

has a richer and easier-to-use interface and much better designed output than

other add-ins for statistical analysis. It may make a good complement if not a

substitute for whatever regression software you are currently using,

Excel-based or otherwise. RegressIt is an excellent tool for interactive

presentations, online teaching of regression, and development of videos of

examples of regression modeling. It includes extensive built-in

documentation and pop-up teaching notes as well as some novel features to

support systematic grading and auditing of student work on a large scale. There

is a separate logistic

regression version with

highly interactive tables and charts that runs on PC's. RegressIt also now

includes a two-way

interface with R that allows

you to run linear and logistic regression models in R without writing any code

whatsoever.

If you have

been using Excel's own Data Analysis add-in for regression (Analysis Toolpak),

this is the time to stop. It has not

changed since it was first introduced in 1993, and it was a poor design even

then. It's a toy (a clumsy one at that), not a tool for serious work. Visit

this page for a discussion: What's wrong with Excel's Analysis Toolpak for regression

Regression

example, part 2: fitting a simple

model

Having already performed some descriptive data

analysis in which we learned quite a bit about relationships and time

patterns among the beer price and beer sales variables, let’s naively

proceed to fit a simple regression model

to predict sales of 18-packs from price of 18-packs. I say “naively” because,

although we know that there is a very strong relationship between price and

demand, the scatterplot indicated that there is a problem with one of the

assumptions of a regression model, namely that vertical deviations from the

regression line (prediction errors) ought to have roughly the same variance for

small and large predictions. Also,

there are some logical problems with a model that assumes the relation between

sales and price to be perfectly linear in situations where the smallest values

of sales are tiny in comparison to the largest ones. Putting those concerns aside for the

moment, here is the standard regression summary output (as formatted by

RegressIt) for a model in which SALES_18PK is the dependent variable and

PRICE_18PK is the independent variable:

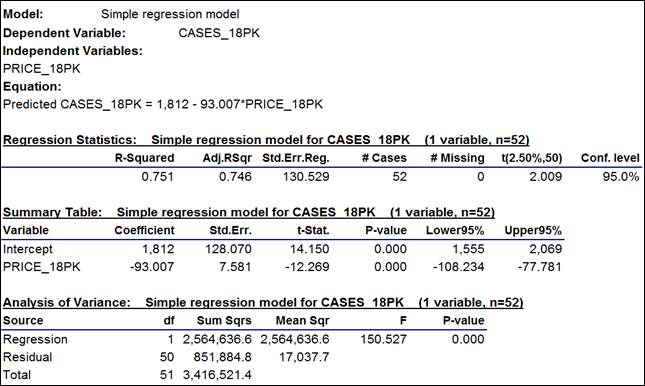

The numbers are interpreted as follows:

a. The

estimated regression equation is printed out at the top: Predicted

CASES_18PK = 1,812 - 93.007*PRICE_18PK. It shows how the coefficients that

appear in the regression summary table below are to be used in predicting sales

from price. This is the equation of

a straight line whose intercept is

1812 (the height of the line at the point where PRICE_18PK is equal to zero,

which it will never come close to in practice) and which has a slope of -93.007, which means the model

predicts that 93 fewer cases worth of

18-packs will be sold per $1 increase

in the price per case.

The intercept in a regression model is rarely a number with any direct economic

or physical meaning. The important

thing to keep in mind about a regression model is that the regression line always passes through the center of mass of the

data, i.e., the point in coordinate space at which all variables are equal

to their mean values. The slope

coefficient(s) tell you how the expected value of the dependent variable will

move away from its mean value as the independent variables move away from their

own mean values. From the

desciptive statistics table, we know that the center of mass of the data for

this regression is the point at which price-per-case for 18-packs is $16.73 and

the number of cases sold is 257.

Just knowing these two numbers tells us that we should predict 257 cases

sold when the price-per-case is $16.73, regardless of the results of fitting

the regression model.

b. The most important number in the output, besides the model coefficients,

is the standard error of the regression, which is 131 in this example. (To 3 decimal places it is 130.529, but

it should be rounded off to an integer value for presentation. Don’t confuse your audience with

more decimal places than are significant.

Many statistical programs routinely display 10 or more digits of

precision in their output tables!)

The standard error of the

regression is the estimated standard deviation of the “noise” in

the dependent variable that is unexplainable by the independent variable(s),

and it is a lower bound on the standard deviation of any of the model’s

forecast errors, under the assumption that the model is correct. The estimated standard deviation of a

forecast error is actually slightly larger

than the standard error of the regression because it must also take into

account the errors in estimating the parameters of the model, but there is not

much difference if the sample size is reasonably large and the values of the

independent variables are not too extreme.

(For details of how the exact standard errors of forecasts are computed,

see the "Mathematics of simple

regression" page or “Notes on linear

regression” handout.)

From the usual 2-standard-error rule of thumb, it follows that a 95% confidence interval for a forecast

from the model is approximately equal

to the point forecast plus or minus 2 times the standard error of the regression. The

exact number of standard errors to use in this calculation is the

“critical t-value” for a two-tailed 95% confidence interval with 50

degrees of freedom, which is 2.009 as shown at the right end of the regression

statistics table. (The number of

“degrees of freedom” for the t-statistic is the number of data

points minus the number of coefficients estimated, which is 52 minus 2 in this

case.)

So, in this model, the value of 131 for the standard error of the regression

means (roughly) that a 95% confidence interval for any forecast will be equal

to the point forecast plus-or-minus 262 cases. We begin to detect a problem here: the number of cases sold is typically

much less than 100 in weeks when the price level is high. If the model is capable of giving an

accurate point forecast in such a week, then it would be silly to compute a

lower confidence limit for the forecast by subtracting 262 from it!

c. Because this is a simple regression

model, R-squared is merely the square of the correlation between price and

sales: 0.751 = (-0.866)2. This is the fraction of the

variance of the dependent variable that is “explained” by the

independent variable, i.e., the fractional amount by which the variance of the

errors is less than the variance of the dependent variable. Adjusted

R-squared is an unbiased estimate

of the fraction of variable explained, taking into account the sample size and

number of variables in the model, and it is always slightly smaller than

unadjusted R-squared, although the difference is unimportant in this case: both numbers round off to 75%. Adjusted

R-squared has a tight connection with the standard error of the

regression: one goes up as the

other goes down, for models fitted to the same sample of the same dependent

variable.

d. The

estimated intercept is 1812 (cases) with a standard error of 128. The

standard error of a coefficient is the estimated

standard deviation of the error in estimating it. By the usual rule of thumb, an approximate 95% confidence interval for

a coefficient is the point estimate plus or minus two standard errors, which is

1812 +/- 2(128) = [1556,2068] for the intercept. The exact

95% confidence interval is [1555,2069] as shown in the regression summary

table. The difference is trivial,

and in any case the confidence limits only have meaning if the model

assumptions are approximately correct.

e. The cofficient of PRICE_18PK is -93 with

a standard error of 7.6, and its 95% confidence interval is [-108,-78]. This is not too wide an interval

(as these things go), so it appears that we have a reasonably precise estimate

of the strength of the price-demand relationship. Again, though, these numbers are

meaningful only if the model assumptions are approximately correct, in

particular the assumption that the same price-demand relationship holds across

the whole range of prices.

f. The t-statistic of a coefficient

estimate is its point value divided by its standard error, i.e., its

“number of standard errors away from zero.” In general we do not care about the t-stat

of the intercept unless it is

possible for all the independent variables to simultaneously go to zero and we

are interested in whether the prediction should also be zero in such a

situation. (That is not the case

here.) The t-stat of the slope

coefficient is -93.007/7.581 = -12.269. By the usual rule of thumb, a coefficient estimate is significantly

different from zero (at the 0.05 level of significance) if its t-stat is

greater than 2 in magnitude, which is certainly true here. (Again, the exact critical t-value

is 2.009, not 2, for this model, but the difference is not important.)

The t-statistic of a coefficient estimate exceeds the specified critical value

if and only if the corresponding confidence interval for the coefficient does

not include zero: this is a

mathematical identity. So, it is

equivalent to check to see whether the magnitude of the t-statistic exceeds the

critical value for the given level of confidence or to check to see whether the

correponding confidence interval includes zero.

g. In

the analysis-of-variance table, the

only interesting numbers are the

F-statistic and its P-value.

The F-statistic tests whether all the independent variables in the model

are “jointly” significant, regardless of whether they are

individually significant. In a

simple regression model, there is only one independent variable, so the the

F-statistic tests its significance alone.

In fact, in a simple regression

model, the F-statistic is simply the square of the t-statistic of the slope

coefficient, and their P-values are the same. In this case we have 150.527 = (-12.269)2. The F-statistic is usually not of

interest unless you have a group of variables that should logically be taken together

as a unit (say, dummy variables for a set of mutually exclusive conditions, as

you might have in a designed experiment), and therefore the

analysis-of-variance table is minimized (hidden) by default in RegressIt.

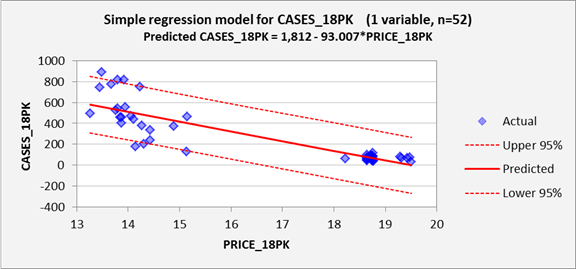

Now, for a better perspective on how well the model fits the data,

let’s look at the graphical output.

First, here is the line fit plot, which shows the regression line

superimposed on the data. This is

exactly the same line that was superimposed on the scatterplot in the

descriptive data analysis, except that it also shows 95% confidence bands for

forecasts.

Here we see a couple of problems.

First, as already noted, the

unexplained deviations from the regression line are much larger for low price

levels than for high price levels. Under the assumptions of the regression

model, they should be approximately the same size across the whole range, as

indicated by the fact that the 95% confidence bands have an almost constant

width over the whole range. In

theory, at every price level, roughly 95% of the data should fall within the

95% confidence bands, and the vertical

deviations from the regression line should be identically normally distributed.

Also note that there is a hole in the middle of the price range: no values in

between the low $15’s and the low $18’s were observed. This is not necessarily a problem as far

as the regression model is concerned:

there is no requirement that values of the independent variable(s) should have any particular sort of

distribution. They might even take on only integer values, perhaps just

0’s and 1’s.

What’s important is how the values of the dependent variable are distributed, for any given values of the

independent variable(s).

An even more serious logical problem is also observed in this plot: the

model predicts negative values of sales for prices larger than $19.50 per case

(just barely outside the historical range), and the lower 95% confidence limit

for a prediction is negative for prices larger than about $16.50 per case. So, the predictions and confidence

intervals for high price levels cannot be taken very seriously! One alternative modeling strategy that

suggests itself is that the sales data for 18-packs could be broken up into two

subsets, one for low prices and one for high prices, in light of the fact that

intermediate price levels are typically not used. However, let us suppose that we are

interested in predicting what might happen

if we were to set the price to some arbitrary value in the middle range, for

which it is necessary to fit one model to all the data.

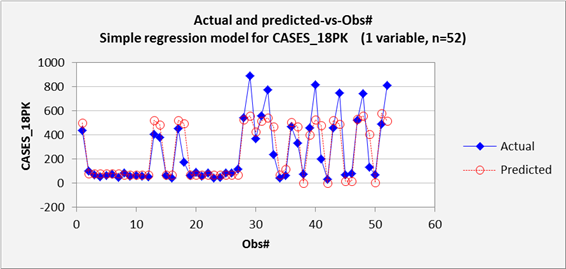

Next let’s look at a time

series plot of actual and predicted values, to see how how the forecasts

and data lined up on a week-to-week basis.

Here we see that the model slightly overpredicted the moderate sales

spikes that occurred early in the year and significantly underpredicted the

large spikes that occurred later in the year. This plot should always be expected to

show some regression-to-the-mean on average, but clearly the model is making

errors for large predictions in a very systematic way. In general, this plot is most useful for

detecting significant time patterns

in the deviations between forecasts and actual values. Here the problem is not a time pattern

in the errors per se.

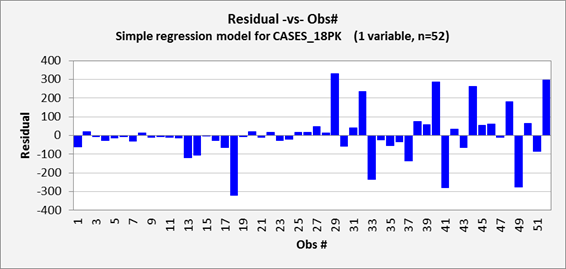

The remainder of the chart output for this model is shown below. The residual-vs-observation-number

chart (i.e., residuals versus

time, which is always important for time series data) shows some detail that

wasn’t quite as apparent on the previous chart, namely that the model

made a few serious overpredictions

(errors that are negative in sign) along with the serious

underpredictions. This

plot is also somewhat unsatisfactory for the fact that it shows that nearly all

of the model’s largest errors occurred in the second half of the

year. The reason for this is clear: most of the price manipulation and most

of the spikes in sales occurred in the second half of the year. Still, the model assumes that the errors

should have the same variance at all points in time, regardless of the values

of the independent variables.

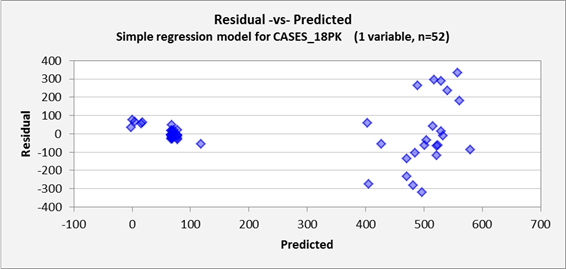

The residual-vs-predicted plot

is where you go to look for evidence of nonlinearities

(which would show up here as a curved

pattern) or heteroscedasticity (errors

that do not have the same variance for all levels of the predictions). Here we see very strong

heteroscedasticity, which was also apparent on the line fit plot: the model makes bigger errors when

making bigger predictions. For a simple regression model, the

residual-vs-predicted plot is just a “tilted” copy of the line fit

plot in which the regression line is superimposed on the X-axis, and it is also

flipped left-to-right if the slope coefficient is negative, as it is here.

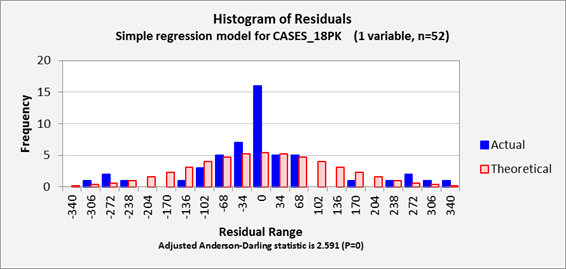

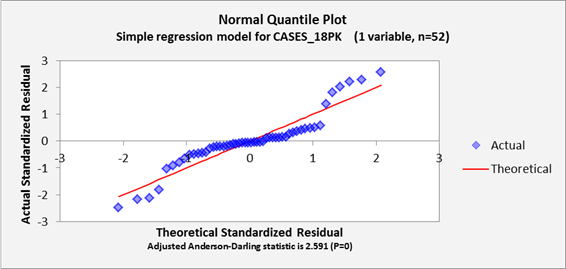

Lastly (at the bottom of this page), we have the residual histogram plot and normal

quantile plot which reveal the shape of the error distribution, along with

the Anderson-Darling statistic which

provides a numerical measure of the degree to which the error distribution is

non-normal. The importance of

testing for normality of the error distribution is that the formulas for

calculating confidence intervals for forecasts are based on properties of the

normal distribution. If the error

distribution is far from normal, then there will be some systematic over- or

under-estimation of “tail area probabilities”. Here, the outliers that are seen

in the histogram plot and the S-shaped pattern that is seen in the normal

quantile plot indicate a signficantly non-normal distribution, as does the A-D

stat, whose value of 2.591 is far above the 0.75 [1.04] critical value for

significance at the 0.05 [0.01] level.

The A-D stat, like other statistical tests for normality, should not be

given an exaggerated importance, particularly when sample sizes are very small

or very large. With very small

samples it is hard to determine much at all about the shape of the error

distribution and with very large samples even a tiny departure from normality

will show up as statistically significant.

(My own preference is to focus on shape of the pattern, if any, that is

seen on the normal quantile plot, and also to look closely at the most extreme

errors to try to figure out what went wrong there.) And like other diagnostic test

statistics for the model assumptions, the

A-D stat is not the bottom line, just a little red flag that may or may not

wave. Still, it provides some

sort of numerical benchmark to go along with the visual impressions of

non-normality that are obtained from the histogram and quantile plots.

What’s the bottom

line? Despite

its high R-squared value, this is not a good model. Its forecasts and their confidence

limits are illogical at high price levels. The relationship between beer

sales and beer price is evidently not linear over such a wide range in prices,

and the model also badly violates the homoscedasticity and normal-distribution

assumptions for the errors.

Let this be a warning: not all significant relationships are

linear, not all random variables are normally distributed, and not all models

with high R-squared values are good ones.