Notes on linear

regression analysis (pdf file)

Introduction to linear

regression analysis

Mathematics

of simple regression

Regression examples

·

Beer sales vs. price, part 1: descriptive

analysis

·

Beer sales vs. price, part 2: fitting a simple

model

·

Beer sales vs.

price, part 3: transformations of variables

·

Beer sales vs.

price, part 4: additional predictors

·

NC natural gas

consumption vs. temperature

·

More regression datasets

at regressit.com

What to

look for in regression output

What’s a good value for R-squared?

What's the bottom line? How to compare models

Testing the assumptions of linear regression

Additional notes on regression analysis

Stepwise and all-possible-regressions

Excel file with

simple regression formulas

Excel file with regression

formulas in matrix form

Notes on logistic regression (new!)

If you use

Excel in your work or in your teaching to any extent, you should check out the latest

release of RegressIt, a free Excel add-in for linear and logistic regression.

See it at regressit.com. The linear regression version runs on both PC's and Macs and

has a richer and easier-to-use interface and much better designed output than

other add-ins for statistical analysis. It may make a good complement if not a

substitute for whatever regression software you are currently using,

Excel-based or otherwise. RegressIt is an excellent tool for interactive

presentations, online teaching of regression, and development of videos of

examples of regression modeling. It includes extensive built-in

documentation and pop-up teaching notes as well as some novel features to

support systematic grading and auditing of student work on a large scale. There

is a separate logistic

regression version with

highly interactive tables and charts that runs on PC's. RegressIt also now

includes a two-way

interface with R that allows

you to run linear and logistic regression models in R without writing any code

whatsoever.

If you have

been using Excel's own Data Analysis add-in for regression (Analysis Toolpak),

this is the time to stop. It has not

changed since it was first introduced in 1993, and it was a poor design even

then. It's a toy (a clumsy one at that), not a tool for serious work. Visit

this page for a discussion: What's wrong with Excel's Analysis Toolpak for regression

Regression

example, part 3: transformations of

variables

In the beer sales example, a simple regression fitted to the original variables

(price-per-case and cases-sold

for 18-packs) yields poor results because it makes wrong assumptions about the

nature of the patterns in the data.

The relationship between the two variables is not linear, and if a

linear model is fitted anyway, the errors do not have the distributional

properties that a regression model assumes, and forecasts and lower confidence

limits at the upper end of the price range have negative values. What to do in such a case? In some situations there may be omitted

variables which, if they could be identified and added to the model, would

correct the problems. In other

situations it could be that breaking the data set up into subsets, on the basis

of ranges of the independent variables, would allow linear models to fit

reasonably well. And there are more

complex model types that could be tried--linear regression models are merely

the simplest place to start. But an

often-used and often-successful strategy is to look for transformations of the original variables that straighten out the

curves, normalize the errors, and/or exploit the time dimension.

In modeling consumer demand, a standard

approach is to apply a natural log

transformation to both prices and quantities before fitting a regression

model. As was discussed on the log transformation page in these notes, when a simple linear regression model

is fitted to logged variables, the slope coefficient represents the predicted percent change in the dependent variable

per percent change in the independent

variable, regardless of their current levels. Larger changes in the independent

variable are predicted to result in a compounding

of the marginal effects rather than a linear extrapolation of them. Let’s see how this approach works

on the beer sales data.

Suppose that we apply a natural log

transformation to all 6 of the price and sales variables in the data set, and

let the names of the logged variables be the original variables with

“_LN” appended to them.

(This is the naming convention used by the variable-transformation tool

in RegressIt.) The

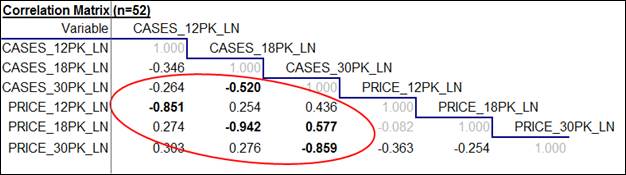

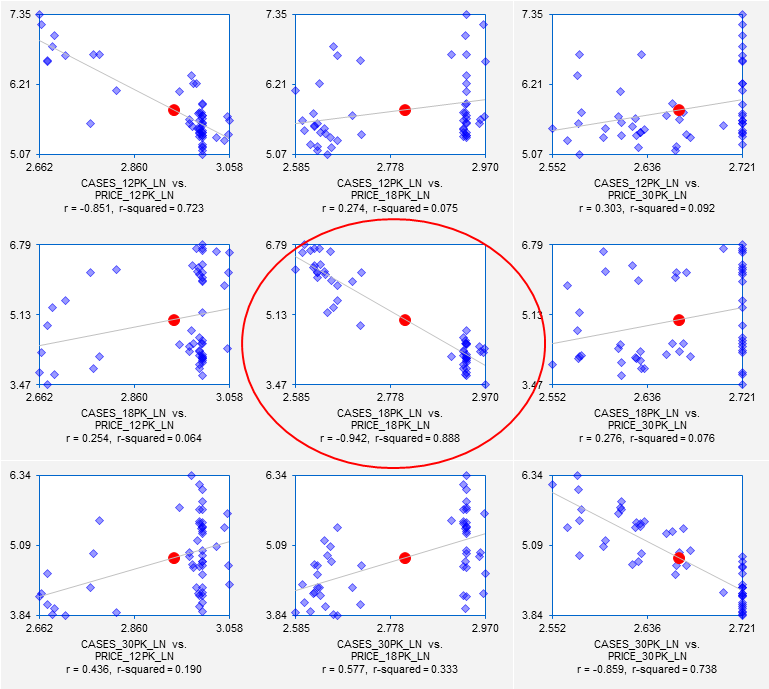

correlation matrix and scatterplot matrix of of the logged variables look like

this:

The correlations are slightly stronger

among the logged variables than among the original variables, and the variance

of the vertical deviations from the regression lines in the scatterplots is now

very similar for both large and small values of the horizontal-axis

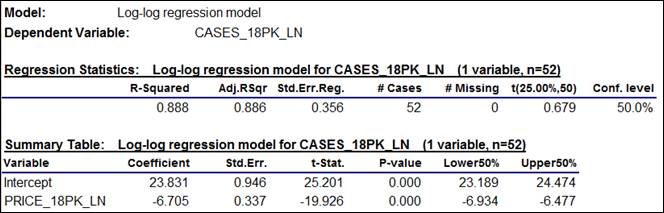

variable. So, let us try fitting a

simple regression model to the logged 18-pack variables. The summary table for the model is shown

below. The slope coefficient of

-6.705 means that on the margin a 1%

change in price is predicted to lead to a 6.7% change in sales, in the opposite

direction, with a compounding of this effect for larger percentage price

changes. The standard error of the

regression of 0.356 is not directly comparable to that of the original model,

because it is measured in log units.

(Return to top of page.)

If the standard error of the regression

in a model fitted to logged data is on the order of 0.1 or less, it can be

roughly interpreted as the standard error of a forecast measured in percentage

terms. For example, if the standard

error of the regression was 0.05, it would be OK to say that the standard error

of a forecast is about 5% of the forecast value. (An increase of 0.05 in the

natural log of variable corresponds to a proportional change of LN(1.05) ≈

0.049, or 4.9%, and a decrease of 0.05 in the natural log corresponds to a

proportional change of LN(0.95) ≈ -0.051, or -5.1%, so +/- 0.05 in log

units is about the same as +/-5% in percentage terms. For a change of +/- 0.1 in the natural

log, the corresponding proportional changes are LN(1.1) ≈ .105 and

LN(0.9) ≈ 0.095, i.e., +10.5% or -9.5%, and so on.) The regression

standard error of 0.356 observed here is too large for that approximation to

apply, i.e., it would not be NOT be OK to say that the standard error of a

forecast is 36% of the forecast value, because the confidence limits are not

sufficiently symmetric around the point forecast. However, this does indicate that the

unexplained variations in demand are fairly large in percentage terms.

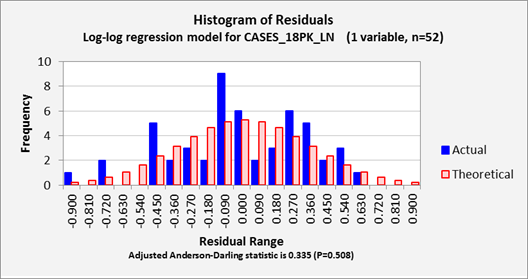

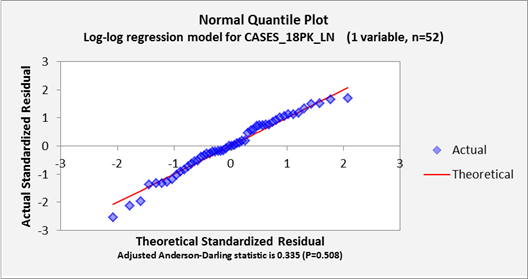

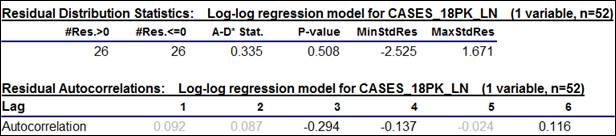

The residual statistics table shows that

the distribution of the errors is very close to a normal distribution (the A-D*

stat is very small, with a P-value on the order of 0.5), and the

autocorrelations of the errors are insignificant at the first couple of

lags. (Unless we are looking for

seasonal patterns, we usually are only concerned with the first couple of lags

as far as autocorrelations are concerned.)

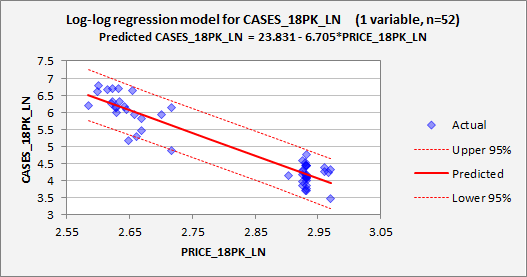

The line fit plot also looks very

good: the vertical deviations from

the regression line are approximately the same size for large and small predictions,

and they nicely fill the space between the 95% confidence limits.

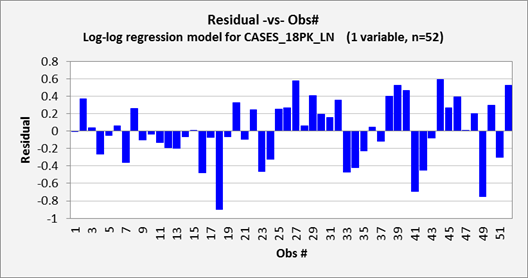

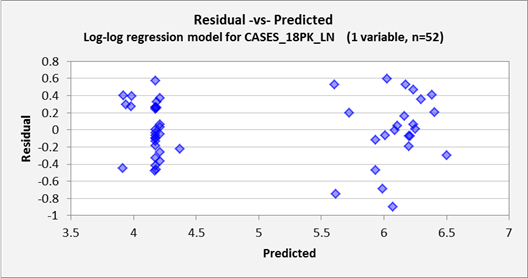

The rest of the chart output of the model

is shown farther down on this page, and it all looks reasonably good, so I will

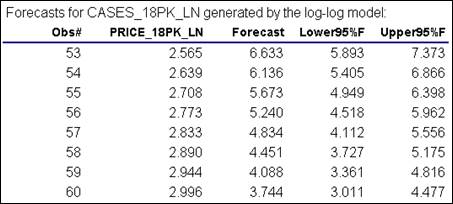

not discuss it further. What is of special interest is the

appearance of the forecasts that are generated by this model when they are

translated from log units back into real units of cases. This requires applying the EXP

function to the forecasts and their lower and upper confidence limits generated

by the log-log model. (Return to top of page.)

All regression software has the

capability to generate forecasts for additional values of the independent

variables provided by the user.

Often the convention is for the program to automatically generate forecasts for any rows of data where the

independent variables are all present and the dependent variable is

missing. That convention is

followed in RegressIt. Here,

forecasts for log sales have been automatically generated for integer-valued

prices in the range from $13 to $20 (numbers that are just outside the

historical minimum and maximum), which were included in the original data

file.

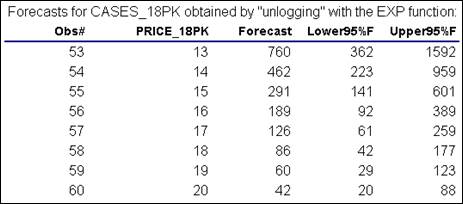

Here are the results of applying the EXP

function to the numbers in the table above to convert them back to real units:

Note that all the numbers are positive,

and the widths of the confidence intervals are proportional to the size of the

forecasts. They are not symmetric,

though: they are wider on the high

side than the low side, which is logical.

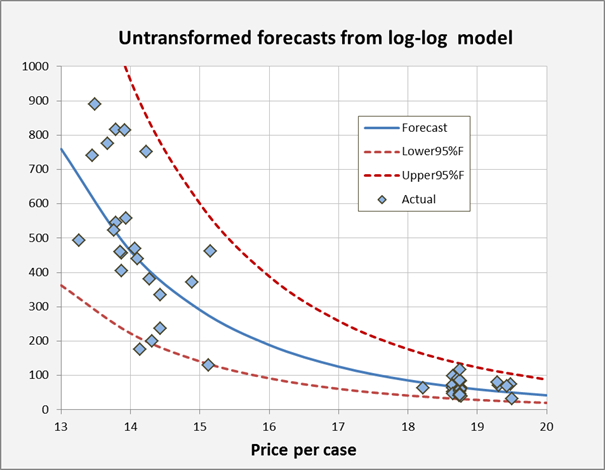

Here’s a chart generated from the last table, which tells the

story: the nonlinear forecast curve

captures the steeper slope of the pattern in the data at low price levels, and

the confidence limits fit the magnitudes of random variations at both low and

high price levels.

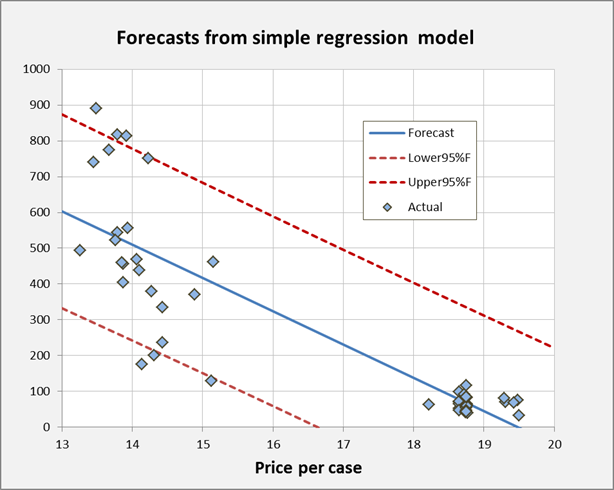

For purposes of comparison, here is a

similarly formatted chart of forecasts produced by the original regression

model for unlogged data. Which

looks more reasonable?

The rest of the chart output from the

log-log model is shown farther down on this page, and it looks fine as

regression models go. The

take-aways from this step of the analysis are the following:

·

The log-log model is well

supported by economic theory and it does a very plausible job of fitting the

price-demand pattern in the beer sales data.

·

The nonlinear curve in the

(unlogged) forecasts adapts to the steeper slope in the demand function at low

price levels.

·

The way in which the width

of the confidence intervals scales in proportion to the forecasts provides a

good fit to the vertical distribution of sales values at different price

levels.

·

It is impossible for the

log-log model’s forecasts or confidence limits for real sales to be

negative.

There is more to be done with this

analysis, namely considering the effects of other variables. Click here to proceed to that step.